Columbia Sportswear 2003 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2003 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

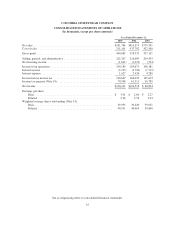

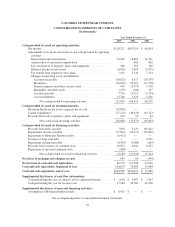

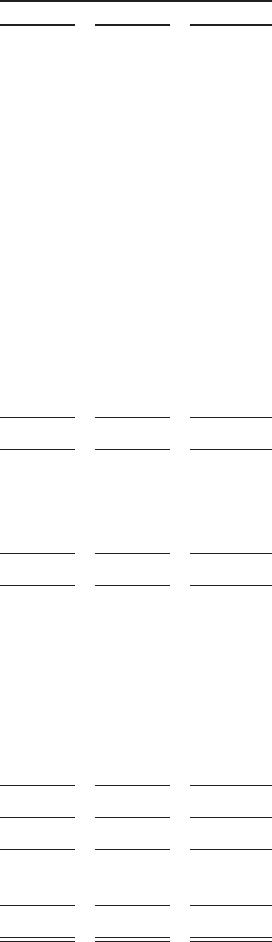

COLUMBIA SPORTSWEAR COMPANY

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

Year Ended December 31,

2003 2002 2001

Cash provided by (used in) operating activities:

Netincome ................................................ $120,121 $102,518 $ 88,824

Adjustments to reconcile net income to net cash provided by operating

activities:

Depreciation and amortization ............................... 23,065 18,685 16,741

Amortization of unearned compensation ....................... — 682 682

Loss on disposal of property, plant, and equipment ............... 268 165 140

Deferred income tax provision ............................... (4,002) 2,895 (2,075)

Tax benefit from employee stock plans ........................ 7,455 2,749 7,514

Changes in operating assets and liabilities:

Accounts receivable ..................................... (30,825) 6,517 (29,379)

Inventories ............................................. (16,635) 23,001 (11,738)

Prepaid expenses and other current assets .................... 439 (2,075) 1,718

Intangibles and other assets ............................... (279) (184) 127

Accounts payable ....................................... 7,726 11,919 (9,754)

Accrued liabilities ....................................... 13,766 1,679 5,476

Net cash provided by operating activities ................. 121,099 168,551 68,276

Cash provided by (used in) investing activities:

Mountain Hardwear net assets acquired, net of cash ................ (29,865) — —

Capital expenditures ......................................... (17,118) (38,023) (39,727)

Proceeds from sale of property, plant, and equipment ............... 103 52 64

Net cash used in investing activities ..................... (46,880) (37,971) (39,663)

Cash provided by (used in) financing activities:

Proceeds from notes payable .................................. 7,858 5,125 158,442

Repaymentsonnotespayable.................................. (17,804) (22,017) (155,069)

Repayment of Mountain Hardwear debt .......................... (6,413) — —

Issuance of long-term debt .................................... — — 4,511

Repayment on long-term debt .................................. (4,504) (5,088) (663)

Proceeds from issuance of common stock ........................ 16,072 6,924 8,223

Repurchase of unvested common stock .......................... (498) — —

Net cash provided by (used in) financing activities ......... (5,289) (15,056) 15,444

Net effect of exchange rate changes on cash ......................... 985 64 (439)

Net increase in cash and cash equivalents .......................... 69,915 115,588 43,618

Cash and cash equivalents, beginning of year ....................... 194,670 79,082 35,464

Cash and cash equivalents, end of year ............................ $264,585 $194,670 $ 79,082

Supplemental disclosures of cash flow information:

Cash paid during the year for interest, net of capitalized interest ...... $ 1,658 $ 2,407 $ 3,503

Cashpaidduringtheyearforincometaxes ....................... 57,284 56,569 49,300

Supplemental disclosures of non-cash financing activities:

Assumption of Mountain Hardwear debt ......................... $ 6,413 $ — $ —

See accompanying notes to consolidated financial statements.

36