Columbia Sportswear 2003 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2003 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

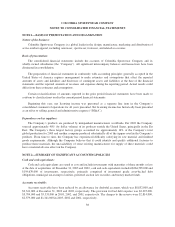

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

technically advanced equipment and apparel for outdoor enthusiasts and professionals. The acquisition was

accounted for under the purchase method of accounting and the results of operations of Mountain Hardwear have

been recorded in the Company’s consolidated financial statements beginning on April 1, 2003. The cost of the

acquisition was allocated on the basis of the estimated fair value of the assets acquired and the liabilities

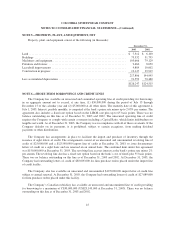

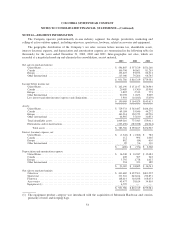

assumed. The fair values of assets and liabilities acquired are presented below (in thousands):

Cash .............................................................................. $ 370

Accounts receivable .................................................................. 6,236

Inventory .......................................................................... 8,600

Prepaids and other assets .............................................................. 19

Property, plant and equipment .......................................................... 440

Intangible assets ..................................................................... 28,357

Total assets acquired ............................................................. 44,022

Accounts payable and accrued liabilities .................................................. 1,181

Deferred tax liabilities ................................................................ 6,193

Debt .............................................................................. 6,413

Total liabilities assumed ........................................................... 13,787

Net assets acquired ............................................................... $30,235

Intangible assets acquired consist of $15.0 million for the trademark and trade names of Mountain

Hardwear, $12.2 million for goodwill and $1.2 million related to patents. The $16.2 million of purchase price

allocated to the trademark and trade names and patents was determined by management, and in part, by a third

party appraiser through established valuation techniques. The trademark and trade names and goodwill are not

subject to amortization as these assets are deemed to have indefinite useful lives. Patents are subject to

amortization over 17 years from the date filed with the U.S. Patent and Trademark Office. At the time of the

acquisition, the remaining useful lives of these patents ranged from 13 to 15 years and the weighted average

useful life is 14.3 years. These intangible assets will be reviewed for impairment in accordance with SFAS

No. 142, “Goodwill and Other Intangible Assets.”

NOTE 4—INVENTORIES, NET

Inventories consist of the following (in thousands):

December 31,

2003 2002

Raw materials ............................................................. $ 3,386 $ 1,540

Work in process ............................................................ 3,692 2,714

Finished goods ............................................................. 119,730 90,608

$126,808 $94,862

44