Columbia Sportswear 2003 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2003 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.COLUMBIA SPORTSWEAR COMPANY

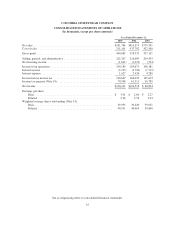

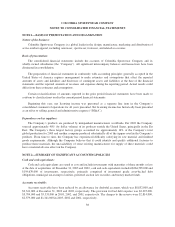

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

of the asset. The Company compares the estimated fair value of goodwill and intangible assets to the carrying

value. If the carrying value exceeds the estimate of fair value, the Company calculates impairment as the excess

of the carrying value over the estimated fair value. The estimates of fair value in goodwill and indefinite-lived

intangible asset tests are based on a number of factors, including assumptions and estimates for projected sales,

income, cash flows, and other operating performance measures. These assumptions and estimates may change in

the future due to changes in economic conditions, in the Company’s ability to meet sales and profitability

objectives, or changes in the Company’s business operations or strategic direction.

Long lived and intangible assets that are determined to have finite lives will continue to be amortized over

their useful lives and are measured for impairment only when events or circumstances indicate the carrying value

may be impaired. In these cases, the Company estimates the future undiscounted cash flows to be derived from

the asset to determine whether a potential impairment exists. If the carrying value exceeds the estimate of future

undiscounted cash flows, the Company then calculates the impairment as the excess of the carrying value of the

asset over the estimate of its fair value. Any impairment charge would be classified as a component of selling,

general, and administrative expense.

The Company has determined that its long-lived assets as of December 31, 2003 and 2002 are not impaired.

Deferred income taxes:

United States income taxes are provided currently on financial statement earnings of non-U.S. subsidiaries

expected to be repatriated. The Company determines annually the amount of undistributed non-U.S. earnings to

invest indefinitely in its non-U.S. operations. Deferred income taxes are provided for temporary differences

between the amount of assets and liabilities for financial and tax reporting purposes. Deferred tax assets are

reduced by a valuation allowance when it is estimated to be more likely than not that some portion of the

deferred tax assets will not be realized.

Revenue Recognition:

The Company records wholesale and licensed product revenues when title passes and the risks and rewards

of ownership have passed to the customer, based on the terms of sale. Title generally passes upon shipment or

upon receipt by the customer depending on the country of the sale and the agreement with the customer. Retail

store revenues are recorded at the time of sale.

In certain countries outside of the U.S., precise information regarding the date of receipt by the customer is

not readily available. In these cases, the Company estimates the date of receipt by the customer based on

historical and expected delivery times by geographic location.

Upon shipment, the Company also provides for estimated sales returns and miscellaneous claims from

customers as reductions to revenues. The estimates are based on historical rates of product returns and claims.

However, actual returns and claims in any future period are inherently uncertain and thus may differ from the

estimates. If actual or expected future returns and claim were significantly greater or lower than the reserves that

had been established, the Company would record a reduction or increase to net revenues in the period in which it

made such determination.

Cost of sales:

The expenses that are included in cost of sales include all direct product and conversion-related costs, and

costs related to shipping, duties and importation. Product warranty costs and specific provisions for excess, close-

out or slow moving inventory are also included in cost of sales.

40