Columbia Sportswear 2003 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2003 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Excluding the effects of exchange rates, Canadian sales increased 8.1%, European direct sales increased

12.4% and net other international sales, excluding Canadian sales and European direct sales, increased 18.9% in

2002 compared to 2001.

Gross Profit: Gross profit as a percentage of net sales was 46.4% in 2002 compared to 45.8% for 2001, an

improvement of 0.6 percentage points. After adjusting our gross margin for the effects of the weaker Euro/U.S.

dollar and Canadian dollar/U.S. dollar currency hedge rates in 2002 compared to 2001, our gross margin

improvement for 2002 was approximately 1.1 percentage points. Foreign currency hedge rates had an

unfavorable effect on our gross margins of approximately 0.5 percentage points. This decrease was more than

offset by favorable sourcing costs, which was the primary factor driving the improved gross margin for 2002. To

a lesser degree, effective inventory management and favorable weather conditions in the northeastern U.S.

allowed for the timely shipping of full-priced fall products and improved margins on off-price selling activities.

Selling, General and Administrative Expense: SG&A expense increased to $216.1 million in 2002 from

$209.5 million for 2001. The 3.2% increase in SG&A expense was primarily the result of an increase in variable

selling and operating expenses to support the higher level of sales. More specifically, variable selling expenses,

including commissions and advertising expense, increased due to the increase in net sales in 2002. The increase

in these variable selling expenses was more than offset by reductions in discretionary marketing programs,

resulting in a decrease in total selling expenses for 2002. An increase in general and administrative expenses

more than offset the decrease in total selling expenses due to increased personnel and depreciation expense. The

increase in personnel expenses was due to an expansion of the Company’s product offerings and to support the

higher level of sales. The increase in depreciation expense was attributable to expanding the capacity of our U.S.

distribution center and moving our corporate headquarters to a larger facility capable of handling our growth.

As a percentage of sales, SG&A expense decreased to 26.5% in 2002 from 26.9% for 2001. The decrease as

a percentage of sales was primarily the result of continued operating efficiencies from global infrastructure

investments and effective cost control measures, which enabled us to leverage several SG&A expenses including

commissions, discretionary marketing programs, and personnel related costs.

Net Licensing Income: Net licensing income increased $0.7 million, or 140.0%, to $1.2 million in 2002

from $0.5 million in 2001. The increase in net licensing income was due to an increase in the sale of packs, belts

and personal leather goods and other newly added licensed products, including watches and leather outerwear.

Interest (Income) Expense, Net: Interest income was $2.8 million in 2002 compared to $1.7 million for

2001 and interest expense was $2.4 million in 2002 compared to $4.3 million for 2001. These changes for 2002

were attributable to an increase in cash compared to 2001 and repayments of short-term notes payable.

Income Tax Expense: The provision for income taxes increased to $61.5 million in 2002 from $56.8

million in 2001. The effective tax rate was 37.5% for 2002 and 39.0% for 2001. The reduction in the 2002

effective tax rate was due to several factors, including the relative mix of international and domestic profitability

and, to a lesser degree, the utilization of foreign tax credits.

Liquidity and Capital Resources

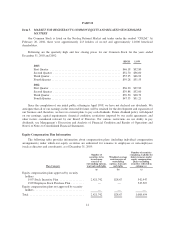

Our primary ongoing funding requirements are to finance working capital and the continued growth of the

business. We financed our operations for the year ended December 31, 2003 primarily through cash provided by

operating activities. At December 31, 2003, we had total cash and cash equivalents of $264.6 million compared

to $194.7 million at December 31, 2002. Cash provided by operating activities was $121.1 million for 2003

compared to $168.6 million in 2002. The decrease in cash provided by operating activities was largely due to an

increase in inventories to support higher sales levels for spring 2004, and an increase in accounts receivable due

to increased sales in the latter part of 2003 and appreciation in foreign currency exchange rates of the Euro and

Canadian dollar against the U.S. dollar. The increase in net income partially offset the increases in inventory and

accounts receivable.

21