Columbia Sportswear 2003 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2003 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

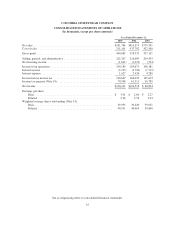

Stock-based compensation:

The Company has elected to follow the accounting provisions of Accounting Principles Board Opinion No. 25

(“APB 25”), “Accounting for Stock Issued to Employees”, for stock-based compensation and to furnish the pro forma

disclosures required under SFAS No. 148, “Accounting for Stock-Based Compensation – Transition and Disclosure.”

No stock-based employee compensation cost is reflected in net income because all options granted under those plans

had an exercise price equal to the market value of the underlying common stock on the date of the grant.

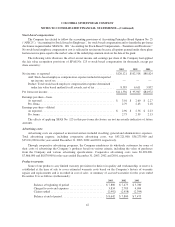

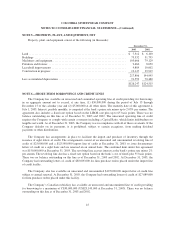

The following table illustrates the effect on net income and earnings per share if the Company had applied

the fair value recognition provisions of SFAS No. 123 to stock-based compensation (in thousands, except per

share amounts):

2003 2002 2001

Net income, as reported ............................................ $120,121 $102,518 $88,824

Add: Stock-based employee compensation expense included in reported

netincome,netoftax ........................................ — — —

Deduct: Total stock-based employee compensation expense determined

under fair value based method for all awards, net of tax ............. 8,585 6,611 3,852

Proformanetincome .............................................. $111,536 $ 95,907 $84,972

Earnings per share—basic

As reported .................................................. $ 3.01 $ 2.60 $ 2.27

Proforma ................................................... 2.79 2.43 2.18

Earnings per share—diluted

As reported .................................................. $ 2.96 $ 2.56 $ 2.23

Proforma ................................................... 2.75 2.39 2.13

The effects of applying SFAS No. 123 in this pro forma disclosure are not necessarily indicative of future

amounts.

Advertising costs:

Advertising costs are expensed as incurred and are included in selling, general and administrative expenses.

Total advertising expense, including cooperative advertising costs, was $43,221,000, $36,273,000 and

$35,011,000 for the years ended December 31, 2003, 2002 and 2001, respectively.

Through cooperative advertising programs, the Company reimburses its wholesale customers for some of

their costs of advertising the Company’s products based on various criteria, including the value of purchases

from the Company and various advertising specifications. Cooperative advertising costs were $9,328,000,

$7,866,000 and $8,870,000 for the years ended December 31, 2003, 2002 and 2001, respectively.

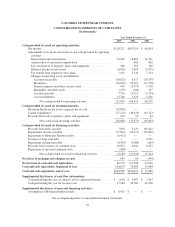

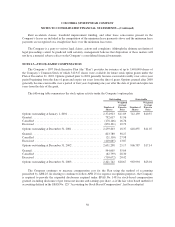

Product warranty:

Some of our products carry limited warranty provisions for defects in quality and workmanship. A reserve is

established at the time of sale to cover estimated warranty costs based on the Company’s history of warranty

repairs and replacements and is recorded in cost of sales. A summary of accrued warranties for the years ended

December 31 is as follows (in thousands):

2003 2002 2001

Balance at beginning of period ....................... $7,800 $7,475 $5,780

Chargedtocostsandexpenses ........................ 3,834 2,783 4,094

Claims settled ..................................... (2,992) (2,458) (2,399)

Balance at end of period ............................. $8,642 $7,800 $7,475

42