Columbia Sportswear 2003 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2003 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

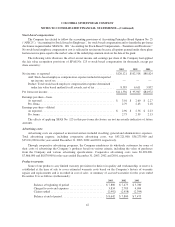

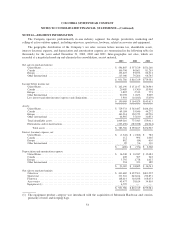

Significant components of the Company’s deferred taxes are as follows (in thousands):

As of December 31

2003 2002

Deferred tax assets:

Non-deductible accruals and allowances ....................................... $15,774 $ 9,047

Capitalized inventory costs .................................................. 2,463 1,793

18,237 10,840

Deferred tax liabilities:

Depreciation and amortization ............................................... (8,870) (91)

Deferred compensation ..................................................... — (522)

Deductible accruals and allowance ............................................ (1,127) —

(9,997) (613)

Total ..................................................................... $ 8,240 $10,227

Non-current deferred tax assets of $795,000 are netted with the non-current deferred tax liabilities line item

on the consolidated balance sheet and $1,486,000 of current deferred tax liabilities are included as a component

of accrued liabilities in the consolidated balance sheet at December 31, 2003.

NOTE 11—PROFIT SHARING PLAN

The Company has a 401(k) profit-sharing plan, which covers substantially all employees with more than

ninety days of service. The Company may elect to make discretionary matching and/or non-matching

contributions. All contributions to the plan are determined by the Board of Directors and totaled $3,291,000,

$2,930,000 and $2,582,000 for the years ended December 31, 2003, 2002, and 2001, respectively.

NOTE 12—COMMITMENTS AND CONTINGENCIES

The Company leases certain operating facilities from related parties of the Company. Total rent expense,

including month-to-month rentals, for these leases amounted to $449,000, $370,000 and $381,000 for the years

ended December 31, 2003, 2002 and 2001, respectively.

Rent expense was $3,401,000, $2,587,000 and $2,568,000 for non-related party leases during the years

ended December 31, 2003, 2002 and 2001, respectively.

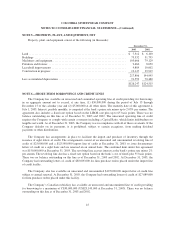

The approximate future minimum payments on all lease obligations at December 31, 2003 are as follows

(amounts in thousands):

Non-related

Parties

Related

Parties Total

2004 ............................................. $3,036 $ 449 $ 3,485

2005 ............................................. 1,927 449 2,376

2006 ............................................. 1,487 449 1,936

2007 ............................................. 1,101 449 1,550

2008 ............................................. 687 449 1,136

Thereafter ........................................ 429 1,347 1,776

$8,667 $3,592 $12,259

49