Columbia Sportswear 2003 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2003 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

The following discussion of our results of operations and liquidity and capital resources, including known

trends and uncertainties identified by management, should be read in conjunction with the Consolidated

Financial Statements and Accompanying Notes that appear elsewhere in this annual report.

All references to years relate to the calendar year ended December 31 of the particular year.

Overview

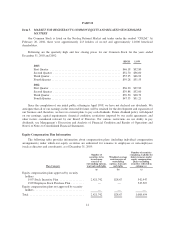

Since our initial public offering in 1998, our net sales have steadily increased from $427.3 million in 1998

to $951.8 million in 2003, which equates to a compound annual growth rate of 17.4% for this period. Although

we cannot predict with certainty any results on a prospective basis, we remain optimistic that we will continue to

benefit from global market opportunities for each of our key product categories. To capitalize on these

opportunities, we are committed to our four-pronged growth strategy of enhancing the retail productivity of our

customers, leveraging the Columbia brand in international markets, further developing our existing merchandise

categories and selectively broadening our retail distribution. With our well developed sourcing and distribution

infrastructure, coupled with a proven design and product development team, we believe that we are well

positioned for future growth.

For the year ended December 31, 2003, we achieved sales growth in each of our product categories. For the

first time in our history, annual sales from outerwear represented less than 50% of total sales, reflecting sales

growth in our footwear and sportswear categories. Sales growth was also realized in each major geographical

area in which we operate.

Our success during 2003 was largely the result of increased international sales, particularly in Europe and in

our international distributor based markets. Our success internationally was enhanced by favorable foreign

currency exchange rates in our direct markets as many foreign currencies strengthened in relation to the U.S.

dollar.

Although changes in foreign currency exchange rates favorably affected our sales and earnings growth in

2003, we believe our intrinsic growth is the result of well developed products, exceptional sourcing capabilities

and strategically focused promotional activities.

As part of our growth strategy to provide a head-to-toe product offering, we have expanded our product line

from our traditional outerwear category to other products including sportswear and footwear. We continue to

experience a shift in our sales product mix from our outerwear category to our footwear and sportswear product

categories. Although sales growth has been achieved in all product categories, sales growth in the footwear and

sportswear categories has outpaced outerwear sales growth. Due to the shift in our sales product mix, our gross

margin has experienced some erosion because outerwear products typically sell at higher gross margins than

other product offerings. During 2003, the erosion in margin due to the shift in sales product mix was offset by the

favorable effect of foreign currency fluctuations. In 2004, we anticipate some margin contraction due to the

continued shift in sales product mix, since we expect sales from footwear and sportswear to continue to grow

faster than outerwear sales. For 2003, our footwear and sportswear product sales grew 35.1% and 27.0%,

respectively, compared to 2002, which is attributable to our existing and improved product offerings and overall

product acceptance by our customers both in the United States and abroad. The outerwear product category was

also successful internationally, with sales growth in Europe, Canada and other international markets. In the

United States, outerwear sales declined due to the relative maturity of the outerwear market domestically.

The challenges in the domestic outerwear market include changes in youth fashion trends. In 2005, our

design emphasis will focus more intently on youth trends and the product line will have greater differentiation

16