Columbia Sportswear 2003 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2003 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Rent escalation clauses, leasehold improvement funding, and other lease concessions present in the

Company’s leases are included in the computation of the minimum lease payments above and the minimum lease

payments are recognized on a straight-line basis over the minimum lease term.

The Company is a party to various legal claims, actions and complaints. Although the ultimate resolution of

legal proceedings cannot be predicted with certainty, management believes that disposition of these matters will

not have a material adverse effect on the Company’s consolidated financial statements.

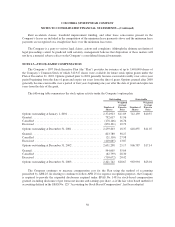

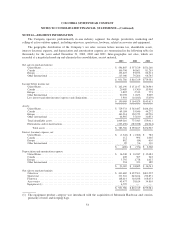

NOTE 13—STOCK-BASED COMPENSATION

The Company’s 1997 Stock Incentive Plan (the “Plan”) provides for issuance of up to 5,400,000 shares of

the Company’s Common Stock of which 542,947 shares were available for future stock option grants under the

Plan at December 31, 2003. Options granted prior to 2001 generally become exercisable ratably over a five-year

period beginning from the date of grant and expire ten years from the date of grant. Options granted after 2000

generally become exercisable over a period of four years beginning one year after the date of grant and expire ten

years from the date of the grant.

The following table summarizes the stock option activity under the Company’s option plan:

Outstanding Exercisable

Number of

Shares

Weighted

Average

Exercise

Price

Number of

Shares

Weighted

Average

Exercise

Price

Options outstanding at January 1, 2001 ....................... 2,374,923 $11.89 712,139 $10.37

Granted................................................ 732,617 31.96

Cancelled .............................................. (178,146) 16.76

Exercised .............................................. (670,191) 10.73

Options outstanding at December 31, 2001 .................... 2,259,203 18.37 618,855 $11.07

Granted................................................ 823,780 38.27

Cancelled .............................................. (21,110) 27.98

Exercised .............................................. (410,665) 13.87

Options outstanding at December 31, 2002 .................... 2,651,208 25.17 906,787 $17.14

Granted................................................ 544,005 35.04

Cancelled .............................................. (62,799) 28.30

Exercised .............................................. (710,672) 20.42

Options outstanding at December 31, 2003 .................... 2,421,742 $28.67 963,994 $23.01

The Company continues to measure compensation cost for the Plan using the method of accounting

prescribed by APB 25. In electing to continue to follow APB 25 for expense recognition purposes, the Company

is required to provide the expanded disclosures required under SFAS No. 148 for stock-based compensation

granted, including disclosure of pro forma net income and earnings per share, as if the fair value based method of

accounting defined in the SFAS No. 123 “Accounting for Stock-Based Compensation”, had been adopted.

50