Columbia Sportswear 2003 Annual Report Download - page 27

Download and view the complete annual report

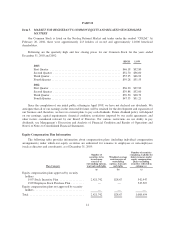

Please find page 27 of the 2003 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Our primary capital requirements are for working capital, investing activities associated with the expansion

of our global operations and general corporate needs. Net cash used in investing activities was $46.9 million in

2003 and $38.0 million for the comparable period in 2002. In 2003, our investing activities included $29.9

million for the acquisition of Mountain Hardwear, net of cash acquired, and $17.1 million for capital

expenditures including approximately $10.4 million related to the initial phase of construction of a distribution

center in Henderson County, Kentucky.

Cash used in financing activities was $5.3 million in 2003 and $15.1 million for the comparable period in

2002. In 2003, net cash used in financing activities was primarily for the net repayment of notes payable of $9.9

million, the repayment of Mountain Hardwear’s debt of $6.4 million, and the repayment of the Company’s long-

term debt of $4.5 million, partially offset by proceeds from the sale of stock under employee stock plans of $16.1

million. In 2002, net cash used in financing activities was primarily due to net repayment of borrowings on short-

term notes payable of $16.9 million and net repayment of $5.1 million on long-term debt, offset by proceeds

from the sale of stock under employee stock plans of $6.9 million.

To fund our domestic working capital requirements, we have available unsecured revolving lines of credit

with aggregate seasonal limits ranging from $30 million to $75 million, of which $5 million to $50 million is

committed. As of December 31, 2003, no domestic balance was outstanding under these lines of credit.

Internationally, our subsidiaries have local currency operating lines in place guaranteed by us with a combined

limit of approximately $88.8 million at December 31, 2003. There were no balances outstanding under these

lines of credit at December 31, 2003.

Additionally, we maintain unsecured and uncommitted lines of credit with a combined limit of $250 million

at December 31, 2003, available for issuing letters of credit. At December 31, 2003, the balance outstanding

under these letters of credit was $110.1 million.

As we continue our investment in global infrastructure to support our growth, we anticipate that capital

expenditures for 2004 will total approximately $45 million, consisting of maintenance capital requirements and

information technology and distribution projects. In 2003, we broke ground on the construction of a distribution

center in Henderson County, Kentucky primarily for the purpose of distributing footwear products. This

distribution center is expected to consist of approximately 450,000 square feet, cost an estimated $40 million to

construct, and begin shipping products in 2005. As of December 31, 2003, capital expenditures for the Kentucky

distribution center totaled approximately $10.4 million.

Although the Kentucky distribution center will be constructed primarily to support our footwear products, it

will be designed and engineered to support other product lines as well. The facility will improve our proximity to

major footwear customers and, we believe, will facilitate reorders. We expect to fund these capital expenditures

with existing cash and cash provided by operations. If the need arises for additional expenditures, we may need

to seek additional funding. Our ability to obtain additional credit facilities will depend on many factors, including

prevailing market conditions, our financial condition, and our ability to negotiate favorable terms and conditions.

We do not assure you that financing will be available on terms that are acceptable or favorable to us, if at all.

Our operations are affected by seasonal trends typical in the outdoor apparel industry, and have historically

resulted in higher sales and profits in the third calendar quarter. This pattern has resulted primarily from the

timing of shipments to wholesale customers for the fall outerwear season. We believe that our liquidity

requirements for at least the next 12 months will be adequately covered by existing cash, cash provided by

operations and existing short-term borrowing arrangements.

22