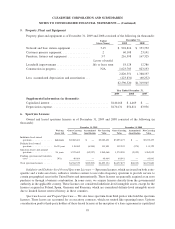

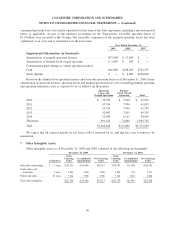

Clearwire 2009 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2009 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

3

.

S

trate

g

ic Transactions

Priv

a

te P

la

cemen

t

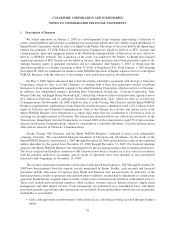

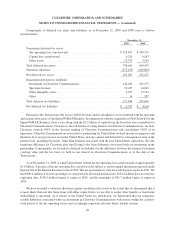

On November 9, 2009, we entered into an investment a

g

reement, which we refer to as the Investmen

t

A

greement, w

i

t

h

eac

h

o

f

Spr

i

nt, Comcast Corporat

i

on, w

hi

c

h

we re

f

er to as Comcast, Inte

l

Corporat

i

on, w

hi

c

h

w

e

r

efer to as Intel, Time Warner Cable Inc., which we refer to as Time Warner Cable, Bri

g

ht House Networks, LLC,

which we refer to as Bri

g

ht House, and Ea

g

le River Holdin

g

s LLC, which we refer to as Ea

g

le River, who w

e

c

o

ll

ect

i

ve

l

yre

f

er to as t

h

e Part

i

c

i

pat

i

ng Equ

i

ty

h

o

ld

ers, prov

idi

ng

f

or a

ddi

t

i

ona

l

equ

i

ty

i

nvestments

b

yt

h

e

P

articipatin

g

Equit

y

holders and new debt investments b

y

certain of these investors. The Investment A

g

reement

s

ets forth the terms of the transactions pursuant to which the Participatin

g

Equit

y

holders will invest in Clearwire

Communications an aggregate of approximately

$

1.564 billion in exchange for 213,369,711 shares of Clearwir

e

Commun

i

cat

i

ons non-vot

i

n

g

C

l

ass B equ

i

t

yi

nterests an

d

C

l

earw

i

re Commun

i

cat

i

ons vot

i

n

gi

nterests, w

hi

c

h

w

e

r

efer to as the Private Placement, and the investment b

y

certain of the Participatin

g

Equit

y

holders in senior secure

d

n

otes, discussed below, which we refer to as the Rollover Notes, in re

p

lacement of e

q

ual amounts of indebtedness

un

d

er t

h

e sen

i

or term

l

oan

f

ac

ili

t

y

t

h

at we assume

df

rom O

ld

C

l

earw

i

re, w

hi

c

h

we re

f

er to as t

h

e Sen

i

or Term Loa

n

Fac

ili

t

y

.

Additionall

y

, on November 24, 2009, Clearwire Communications completed an offerin

g

of $1.85 billion

12% senior secured notes due 2015 (includin

g

the Rollover Notes), followed b

y

a second offerin

g

of $920 million

12% senior secured notes due 201

5

that closed on December 9, 2009, which we refer to collectively as the Senio

r

S

ecure

d

Notes. See Note 10, Lon

g

-term De

b

t

.

Th

ePr

i

vate P

l

acement was to

b

e consummate

di

nt

h

ree c

l

os

i

ngs. On Novem

b

er 9, 2009, t

h

e Part

i

c

i

pat

i

n

g

Equit

y

holders contributed in a

gg

re

g

ate approximatel

y

$1.057 billion in cash in exchan

g

e for 144,231,268

Clearwire Communications non-votin

g

Class B equit

y

interests, which we refer to as Clearwire Communications

C

l

ass B Common Interests, an

d

C

l

earw

i

re Commun

i

cat

i

ons vot

i

ng

i

nterests, w

hi

c

h

we re

f

er to as C

l

earw

i

r

e

Communications Votin

g

Interests, pro rata based on their respective investment amounts. We refer to this closin

g

a

s

t

he First Investment Closin

g

. On December 21, 2009, the Participatin

g

Equit

y

holders contributed in a

gg

re

g

at

e

approximately

$

440.3 million in cash in exchange for 60,066,822 Clearwire Communications Class B Common

Interests an

d

C

l

earw

i

re Commun

i

cat

i

ons Vot

i

n

g

Interests. We re

f

er to t

hi

sc

l

os

i

n

g

as t

h

e Secon

d

Investmen

t

Closing. The remaining approximately

$

66.5 million to be contributed under the Investment Agreement will clos

e

when certain financial information is provided to Sprint for use in its financial reporting with respect to the fiscal

y

ear en

di

n

g

Decem

b

er 31, 2009. We re

f

er to t

h

e consummat

i

on o

f

t

hi

s purc

h

ase as t

h

eT

hi

r

d

Investment C

l

os

i

n

g

.

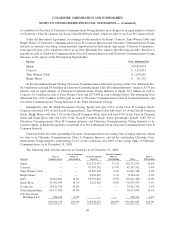

I

nt

h

ePr

i

vate P

l

acement, t

h

e Part

i

c

i

pat

i

ng Equ

i

ty

h

o

ld

ers agree

d

to

i

nvest

i

nC

l

earw

i

re Commun

i

cat

i

ons a tota

l

of $1.564 billion in exchan

g

e for Clearwire Communications Class B Common Interests and Clearwire Commu

-

ni

cat

i

ons Vot

i

ng Interests

i

nt

h

e

f

o

ll

ow

i

ng amounts (

i

nm

illi

ons, except

f

or Interests):

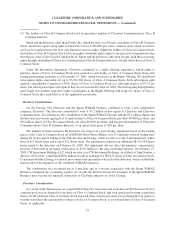

I

n

ves

t

or

I

n

ves

tm

e

nt

I

nt

e

r

es

t

s

Spr

i

nt...................................................

$

1

,

176.0 160

,

436

,

56

2

C

omcas

t

.

...............................................

.

196.0 26

,

739

,

42

7

T

ime Warner Cabl

e

.

....................................... 103.0 14

,

0

5

1

,

84

1

B

ri

g

ht House

.............................................

19.0 2,

5

92,08

7

I

n

tel

....................................................

5

0.0 6,821,282

Ea

gl

eR

i

ver

..............................................

20.0 2,728,512

$

1

,

564.0 213

,

369

,

71

1

I

mme

di

ate

ly f

o

ll

ow

i

n

g

t

h

e rece

i

pt

by

t

h

e Part

i

c

i

pat

i

n

g

Equ

i

t

yh

o

ld

ers o

f

C

l

earw

i

re Commun

i

cat

i

ons C

l

ass B

Common Interests and Clearwire Communications Voting Interests, each of the Participating Equityholders agree

d

89

CLEARWIRE CORPORATION AND

S

UB

S

IDIARIE

S

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS —

(

Continued

)