Clearwire 2009 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2009 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.REPORT OF INDEPENDENT REGI

S

TERED PUBLIC ACCOUNTING FIR

M

To the Board of Directors and Stockholders of Clearwire Corporation

Ki

r

kl

an

d

,Was

hi

ngto

n

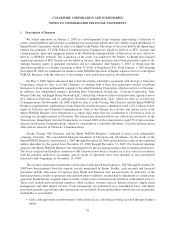

We have audited Clearwire Corporation and subsidiaries (the “Company”) internal control over financial

r

eport

i

ng as o

f

Decem

b

er 31, 2009,

b

ase

d

on cr

i

ter

i

a esta

bli

s

h

e

di

nInterna

l

Contro

l

— Inte

g

rate

d

Framewor

k

i

ssue

db

yt

h

e Comm

i

ttee o

f

Sponsor

i

ng Organ

i

zat

i

ons o

f

t

h

e Trea

d

way Comm

i

ss

i

on. T

h

e Company’s managemen

t

i

s respons

ibl

e

f

or ma

i

nta

i

n

i

ng e

ff

ect

i

ve

i

nterna

l

contro

l

over

fi

nanc

i

a

l

report

i

ng an

df

or

i

ts assessment o

f

t

he

e

ffectiveness of internal control over financial reportin

g

, included in the accompan

y

in

g

Mana

g

ement’s Report on

Internal Control over Financial Reportin

g

. Our responsibilit

y

is to express an opinion on the Compan

y

’s internal

c

ontrol over financial reportin

g

based on our audit.

We con

d

ucte

d

our au

di

t

i

n accor

d

ance w

i

t

h

t

h

e stan

d

ar

d

so

f

t

h

ePu

bli

c Compan

y

Account

i

n

g

Overs

igh

t Boar

d

(

United States). Those standards re

q

uire that we

p

lan and

p

erform the audit to obtain reasonable assurance about

w

hether effective internal control over financial reportin

g

was maintained in all material respects. Our audi

t

i

ncluded obtainin

g

an understandin

g

of internal control over financial reportin

g

, assessin

g

the risk that a material

w

eakness exists, testing and evaluating the design and operating effectiveness of internal control based on that risk,

an

d

per

f

orm

i

ng suc

h

ot

h

er proce

d

ures as we cons

id

ere

d

necessary

i

nt

h

ec

i

rcumstances. We

b

e

li

eve t

h

at our au

di

t

p

rov

id

es a reasona

bl

e

b

as

i

s

f

or our op

i

n

i

on

.

A company’s internal control over financial reporting is a process designed by, or under the supervision of, th

e

c

ompany’s principal executive and principal financial officers, or persons performing similar functions, an

d

eff

ecte

db

yt

h

e company’s

b

oar

d

o

fdi

rectors, management, an

d

ot

h

er personne

l

to prov

id

e reasona

bl

e assurance

r

e

g

ar

di

n

g

t

h

ere

li

a

bili

t

y

o

ffi

nanc

i

a

l

report

i

n

g

an

d

t

h

e preparat

i

on o

ffi

nanc

i

a

l

statements

f

or externa

l

purposes

i

n

accor

d

ance w

i

t

hg

enera

lly

accepte

d

account

i

n

g

pr

i

nc

i

p

l

es. A compan

y

’s

i

nterna

l

contro

l

over

fi

nanc

i

a

l

report

i

n

g

i

nc

l

u

d

es t

h

ose

p

o

li

c

i

es an

dp

roce

d

ures t

h

at (1)

p

erta

i

ntot

h

ema

i

ntenance o

f

recor

d

st

h

at,

i

n reasona

bl

e

d

eta

il

,

accuratel

y

and fairl

y

reflect the transactions and dispositions of the assets of the compan

y

; (2) provide reasonabl

e

assurance that transactions are recorded as necessary to permit preparation of financial statements in accordanc

e

w

ith accounting principles generally accepted in the United States, and that receipts and expenditures of th

e

c

ompany are

b

e

i

ng ma

d

eon

l

y

i

n accor

d

ance w

i

t

h

aut

h

or

i

zat

i

ons o

f

management an

ddi

rectors o

f

t

h

e company; an

d

(

3) prov

id

e reasona

bl

e assurance regar

di

ng prevent

i

on or t

i

me

l

y

d

etect

i

on o

f

unaut

h

or

i

ze

d

acqu

i

s

i

t

i

on, use, o

r

di

spos

i

t

i

on o

f

t

h

e compan

y

’s assets t

h

at cou

ld h

ave a mater

i

a

l

e

ff

ect on t

h

e

fi

nanc

i

a

l

statements.

B

ecause o

f

t

h

e

i

n

h

erent

li

m

i

tat

i

ons o

fi

nterna

l

contro

l

over

fi

nanc

i

a

l

report

i

ng,

i

nc

l

u

di

ng t

h

e poss

ibili

ty o

f

c

o

ll

us

i

on or

i

mproper management overr

id

eo

f

contro

l

s, mater

i

a

l

m

i

sstatements

d

ue to error or

f

rau

d

may not

b

e

p

revente

d

or

d

etecte

d

on a t

i

me

ly b

as

i

s. A

l

so, pro

j

ect

i

ons o

f

an

y

eva

l

uat

i

on o

f

t

h

ee

ff

ect

i

veness o

f

t

h

e

i

nterna

l

c

ontro

l

over

fi

nanc

i

a

l

report

i

n

g

to

f

uture per

i

o

d

s are su

bj

ect to t

h

er

i

s

k

t

h

at t

h

e contro

l

sma

yb

ecome

i

na

d

equate

b

ecause of chan

g

es in conditions, or that the de

g

ree of compliance with the policies or procedures ma

y

deteriorate.

A mater

i

a

l

wea

k

ness

i

sa

d

e

fi

c

i

ency, or a com

bi

nat

i

on o

fd

e

fi

c

i

enc

i

es,

i

n

i

nterna

l

contro

l

over

fi

nanc

i

a

l

r

eport

i

n

g

, suc

h

t

h

at t

h

ere

i

s a reasona

bl

e poss

ibili

t

y

t

h

at a mater

i

a

l

m

i

sstatement o

f

t

h

e compan

y

’s annua

l

or

i

nter

i

m

financial statements will not be prevented or detected on a timel

y

basis. The followin

g

material weakness has been

i

dentified and included in mana

g

ement’s assessment: the Compan

y

did not have adequatel

y

desi

g

ned procedures to

p

rovide for the timel

y

updatin

g

and maintainin

g

of accountin

g

records for the network infrastructure equipment.

This material weakness was considered in determining the nature, timing, and extent of audit tests applied in ou

r

audit of the consolidated financial statements as of and for the year ended December 31, 2009, and this report does

n

ot affect our re

p

ort on such financial statements.

I

n our o

p

inion, because of the effect of the material weakness identified above on the achievement of th

e

objectives of the control criteria, the Company has not maintained effective internal control over financial reportin

g

as of December 31

,

2009

,

based on the criteria established i

n

Internal Control — Inte

g

rated Framewor

k

i

ssued b

y

t

he Committee of Sponsoring Organizations of the Treadway Commission.

7

5