Clearwire 2009 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2009 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

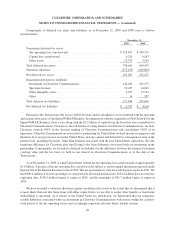

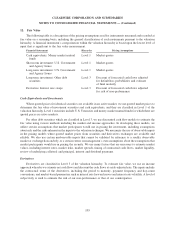

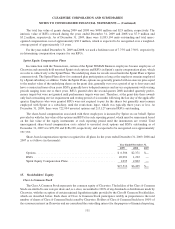

N

otes Receiva

bl

e

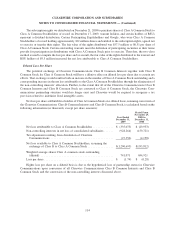

Notes receivable with a carr

y

in

g

value of $5.4 million and a fair value of $1.7 million were outstandin

g

at

D

ecember 31, 2009. Notes receivable with a carrying value of

$

4.8 million and a fair value of

$

1.2 million wer

e

outstan

di

n

g

at Decem

b

er 31, 2008. T

h

e notes rece

i

va

bl

e are not pu

bli

c

ly

tra

d

e

d

.T

h

e

f

a

i

rva

l

ue o

f

t

h

ese notes

is

e

stimated based on the fair value of the underl

y

in

g

collateral

.

Deb

tIn

s

trum

e

nt

s

Senior Secured Notes and Rollover Notes with a carrying value of

$

2.71 billion and an approximate fair value

of

$

2.81 billion were outstanding at December 31, 2009. To estimate fair value of these notes we used the averag

e

i

ndicative

p

rice from several market makers.

A Senior Term Loan Facilit

y

with a carr

y

in

g

value and an approximate fair value of

$

1.36 billion was

outstan

di

n

g

at Decem

b

er 31, 2008. T

h

e Sen

i

or Term Loan Fac

ili

t

y

was not pu

bli

c

ly

tra

d

e

d

. To est

i

mate

f

a

i

rva

l

ue o

f

t

he Senior Term Loan Facilit

y

, we used an income approach whereb

y

we estimated contractual cash flows an

d

di

scounte

d

t

h

e cas

hfl

ows at a r

i

s

k

-a

dj

uste

d

rate. T

h

e

i

nputs

i

nc

l

u

d

e

d

t

h

e contractua

l

terms o

f

t

h

e Sen

i

or Term Loan

Fac

ili

t

y

an

d

mar

k

et-

b

ase

d

parameters suc

h

as

i

nterest rate

f

orwar

d

curves. A

l

eve

l

o

f

su

bj

ect

i

v

i

t

y

an

dj

u

dg

ment was

used to estimate credit spread. The Senior Term Loan Facilit

y

was retired in the fourth quarter of 2009.

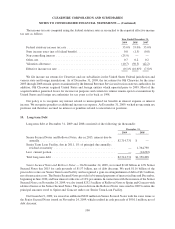

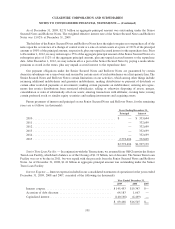

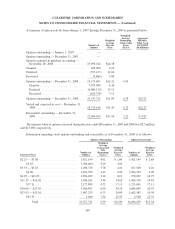

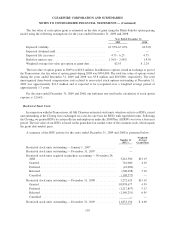

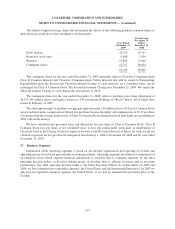

13. Commitments and Contingencies

Future m

i

n

i

mum payments un

d

er o

bli

gat

i

ons

li

ste

db

e

l

ow (

i

nc

l

u

di

ng a

ll

opt

i

ona

l

expecte

d

renewa

l

per

i

o

d

son

operat

i

ng

l

eases) as o

f

Decem

b

er 31, 2009, are as

f

o

ll

ows (

i

nt

h

ousan

d

s):

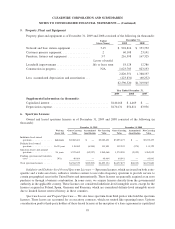

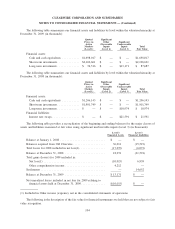

T

o

t

a

l 2010 2011 2012 201

3

201

4

Thereafter

,

including all

r

enewal

p

er

i

ods

Long-term

d

e

b

t

o

bli

g

ations . . . . . . . . $ 2,772,494 $ — $ — $ — $ — $ — $ 2,772,49

4

Interest payments . . . . . 1,997,139 333,

6

44 332,

6

99 332,

6

99 332,

6

99 332,

6

99 332,

6

99

Operating leas

e

o

bli

g

ations . . . . . . . . 6,496,660 214,717 219,522 221,757 223,383 223,385 5,393,89

6

Spectrum

l

eas

e

o

bligations . . . . . . . .

5

,164,616 127,749 13

5

,073 140,806 140,369 149,860 4,470,7

59

S

p

ectrum servic

e

c

redits . . . . . . . . . . . 95

,

672 986 986 986 986 987 90

,

74

1

S

i

gne

d

spectrum

ag

reements . . . . . . . . 29,983 29,983 — — — —

—

Network e

q

ui

p

men

t

p

urc

h

ase

o

bli

g

ations . . . . . . . . 422,744 422,744 — — — —

—

Other

p

urchase

o

bligations . . . . . . . . 162,474 96,030 30,938 22,040 13,0

5

4 412

—

Total . . . . . . . . . . . . . . $17

,

141

,

782 $1

,

225

,

853 $719

,

218 $718

,

288 $710

,

491 $707

,

343 $13

,

060

,

589

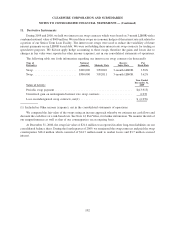

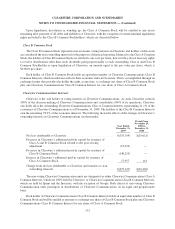

Sp

ectrum an

d

o

p

erating

l

ease o

bl

igation

s

— Our commitments for non-cancelable operating leases consist

m

a

i

n

ly

o

fl

ease

d

spectrum

li

cense

f

ees, o

ffi

ce space, equ

i

pment, an

dl

ease

d

s

i

tes,

i

nc

l

u

di

n

g

towers an

d

roo

f

top

l

ocat

i

ons. Certa

i

no

f

t

h

e

l

eases prov

id

e

f

or m

i

n

i

mum

l

ease pa

y

ments, a

ddi

t

i

ona

l

c

h

ar

g

es an

d

esca

l

at

i

on c

l

auses.

Certain of the tower leases specify a minimum number of new leases to commence by December 31, 2011. Charge

s

app

ly if

t

h

ese comm

i

tments are not sat

i

s

fi

e

d

. Lease

d

spectrum a

g

reements

h

ave terms o

f

up to 30

y

ears. Operat

i

n

g

l

eases

g

enera

lly h

ave

i

n

i

t

i

a

l

terms o

ffi

ve

y

ears w

i

t

h

mu

l

t

i

p

l

e renewa

l

opt

i

ons

f

or a

ddi

t

i

ona

lfi

ve-

y

ear terms tota

li

n

g

between 20 and 2

5y

ears.

1

05

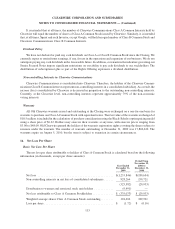

CLEARWIRE CORPORATION AND

S

UB

S

IDIARIE

S

N

OTES TO CONSOLIDATED FINANCIAL STATEMENTS —

(

Continued

)