Clearwire 2009 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2009 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

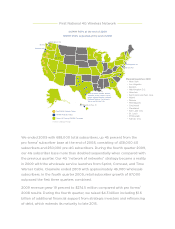

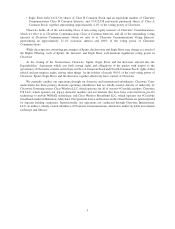

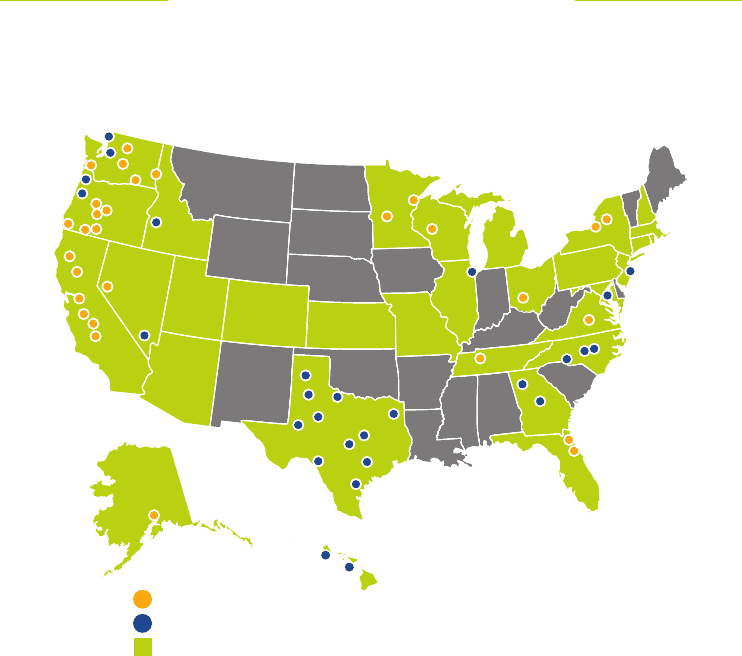

First National 4G Wireless Network

We ended 2009 with 688,000 total subscribers, up 45 percent from the

pro forma1 subscriber base at the end of 2008, consisting of 438,000 4G

subscribers and 250,000 pre-4G subscribers. During the fourth quarter 2009,

our 4G subscriber base more than doubled sequentially when compared with

the previous quarter. Our 4G “network of networks” strategy became a reality

in 2009 with the wholesale service launches from Sprint, Comcast, and Time

Warner Cable. Clearwire ended 2009 with approximately 46,000 wholesale

subscribers. In the fourth quarter 2009, retail subscriber growth of 87,000

outpaced the fi rst three quarters combined.

2009 revenue grew 19 percent to $274.5 million compared with pro forma1

2008 results. During the fourth quarter, we raised $4.3 billion including $1.6

billion of additional fi nancial support from strategic investors and refi nancing

of debt, which extends its maturity to late 2015.

Pre-WiMAX Markets Today

WiMAX Markets Today

Current & Planned WiMAX Coverage

Seattle, WA

Bellingham, WA

Portland, OR

Boise, ID

Las Vegas, NV

Honolulu & Maui, HI

Chicago, IL

Atlanta, GA

Philadelphia, PA

Baltimore, MD

Texas markets include: Abilene,

Amarillo, Austin, Corpus Christi,

Dallas, Killeen/Temple, Lubbock,

Midland/Odessa, San Antonio,

Waco and Wichita Falls

Planned Launches 2010:

• New York

• Los Angeles

• Boston

• Washington D.C.

• Houston

• San Francisco/San Jose

• Miami

• Denver

• Minneapolis

• Cincinnati

• Cleveland

• Salt Lake City

• St. Louis

• Pittsburgh

• Kansas City

Source: Company Filings

44.1MM POPs at the end of 2009

120MM POPs expected at the end of 2010