Clearwire 2009 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2009 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

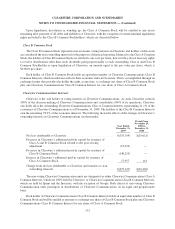

Th

esu

b

scr

i

pt

i

on r

i

g

h

ts we

di

str

ib

ute

d

on Decem

b

er 21, 2009 to purc

h

ase s

h

ares o

f

C

l

ass A Common Stoc

k

to

C

l

ass A Common Stoc

kh

o

ld

ers o

f

recor

d

on Decem

b

er 17

,

2009

,

warrant

h

o

ld

ers

,

an

d

certa

i

n

h

o

ld

ers o

f

RSUs

r

epresent a dividend distribution. Certain Participatin

g

Equit

y

holders and Goo

g

le, who were Class A Common

S

toc

kh

o

ld

ers o

f

recor

dh

o

ldi

ng approx

i

mate

l

y 102 m

illi

on s

h

ares an

d

ent

i

t

l

e

d

to t

h

esu

b

scr

i

pt

i

on r

i

g

h

ts, agree

d

not

t

o exercise or transfer their rights. The fair value of the rights distributed was

$

57.5 million or

$

0.51 per share o

f

Class A Common Stock. Certain outstandin

g

warrants meet the definition of participatin

g

securities as their term

s

p

rovide for participation in distributions with Class A Common Stock prior to exercise. Therefore, the two-class

m

et

h

o

di

s use

d

to compute t

h

e

l

oss per s

h

are an

d

as a resu

l

t, t

h

e

f

a

i

rva

l

ue o

f

t

h

er

igh

ts

di

str

ib

ute

d

to t

h

e warrant an

d

RSU holders of $9.5 million increased the net loss attributable to Class A Common Stockholders.

Diluted Loss Per Share

Th

e potent

i

a

l

exc

h

ange o

f

C

l

earw

i

re Commun

i

cat

i

ons C

l

ass B Common Interests toget

h

er w

i

t

h

C

l

ass

B

Common Stock for Class A Common Stock will have a dilutive effect on diluted loss

p

er share due to certain ta

x

e

ffects. That exchan

g

e would result in both an increase in the number of Class A Common Stock outstandin

g

and a

c

orrespon

di

ng

i

ncrease

i

nt

h

e net

l

oss attr

ib

uta

bl

etot

h

eC

l

ass A Common Stoc

kh

o

ld

ers t

h

roug

h

t

h

ee

li

m

i

nat

i

on o

f

t

he non-controllin

g

interests’ allocation. Further, to the extent that all of the Clearwire Communications Class B

Common Interests and Class B Common Stock are converted to Class A Common Stock, the Clearwire Com-

m

un

i

cat

i

ons partners

hi

p structure wou

ld

no

l

onger ex

i

st an

d

C

l

earw

i

re wou

ld b

e requ

i

re

d

to recogn

i

ze a ta

x

p

rov

i

s

i

on re

l

ate

d

to

i

n

d

e

fi

n

i

te

li

ve

di

ntan

gibl

e assets.

Net

l

oss per s

h

are attr

ib

uta

bl

eto

h

o

ld

ers o

f

C

l

ass A Common Stoc

k

on a

dil

ute

db

as

i

s, assum

i

n

g

convers

i

on o

f

t

he Clearwire Communications Class B Common Interests and Class B Common Stock, is calculated based on th

e

f

o

ll

ow

i

ng

i

n

f

ormat

i

on (

i

nt

h

ousan

d

s, except per s

h

are amounts)

:

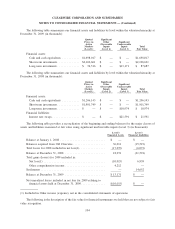

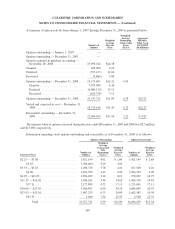

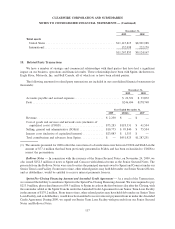

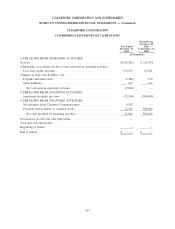

Year Ende

d

December

31,

2009

P

e

r

iod

Fr

om

N

ovember 29

,

2008

to

D

ecember

31

,

2

008

Net

l

oss attr

ib

uta

bl

etoC

l

ass A Common Stoc

kh

o

ld

er

s

.............

$

(

335,073

)$(

29,933

)

N

on-controlling interests in net loss of consolidated subsidiarie

s

......

(

928,264

)(

1

5

9,721

)

Tax ad

j

ustment resultin

g

from dissolution of Clearwir

e

C

ommunications

.......................................

(27,3

5

6) (4,1

5

8

)

N

et loss available to Class A Common Stockholders, assumin

g

th

e

exchan

g

e of Class B to Class A Common Stoc

k

................

$(1,290,693) $(193,812)

Weighted average shares Class A common stock outstandin

g

(

diluted

)

.............................................

7

41

,

071 694

,

921

L

oss

p

er shar

e

...........................................

$

(

1.74

)

$

(

0.28

)

H

igher loss per share on a diluted basis is due to the hypothetical loss of partnership status for Clearwir

e

Commun

i

cat

i

ons upon convers

i

on o

f

a

ll

C

l

earw

i

re Commun

i

cat

i

ons C

l

ass B Common Interests an

d

C

l

ass B

Common Stoc

k

an

d

t

h

e convers

i

on o

f

t

h

e non-contro

lli

n

gi

nterests

di

scusse

d

a

b

ove

.

114

CLEARWIRE CORPORATION AND

S

UB

S

IDIARIE

S

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS —

(

Continued

)