Clearwire 2009 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2009 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

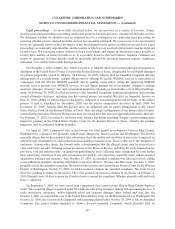

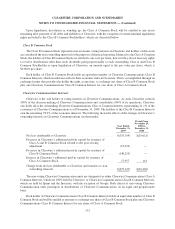

I

t

i

s

i

nten

d

e

d

t

h

at at a

ll

t

i

mes, t

h

e num

b

er o

f

C

l

earw

i

re Commun

i

cat

i

ons C

l

ass A Common Interests

h

e

ld b

y

C

l

earw

i

re w

ill

equa

l

t

h

e num

b

er o

f

s

h

ares o

f

C

l

ass A Common Stoc

ki

ssue

db

yC

l

earw

i

re. S

i

m

il

ar

l

y,

i

t

i

s

i

nten

d

e

d

t

hat, at all times, Sprint and each Investor, except Goo

g

le, will hold an equal number of Class B Common Stock an

d

Cl

ear

wi

re

C

ommun

i

cat

i

ons

Cl

ass B

C

ommon Interests.

Divi

d

en

d

Po

l

ic

y

We have not declared or paid any cash dividends on Class A or Class B Common Stock since the Closing. W

e

c

urrent

l

y expect to reta

i

n

f

uture earn

i

ngs,

if

any,

f

or use

i

nt

h

e operat

i

ons an

d

expans

i

on o

f

our

b

us

i

ness. We

d

o not

ant

i

c

i

pate pa

yi

n

g

an

y

cas

hdi

v

id

en

d

s

i

nt

h

e

f

oreseea

bl

e

f

uture. In a

ddi

t

i

on, covenants

i

nt

h

e

i

n

d

enture

g

overn

i

n

g

ou

r

S

enior Secured Notes impose significant restrictions on our ability to pay cash dividends to our stockholders. Th

e

di

str

ib

ut

i

on o

f

su

b

scr

i

pt

i

on r

i

g

h

ts as part o

f

t

h

eR

i

g

h

ts O

ff

er

i

ng represents a

di

v

id

en

ddi

str

ib

ut

i

on

.

Non-contro

ll

ing Interests in C

l

earwire Communications

C

learwire Communications is consolidated into Clearwire. Therefore

,

the holders of the Clearwire Commu-

ni

cat

i

ons C

l

ass B Common Interests represent non-contro

lli

n

gi

nterests

i

n a conso

lid

ate

d

su

b

s

idi

ar

y

. As a resu

l

t, t

he

i

ncome (loss) consolidated b

y

Clearwire is decreased in proportion to the outstandin

g

non-controllin

g

interests

.

Current

l

y, at t

h

eC

l

earw

i

re

l

eve

l

, non-contro

lli

ng

i

nterests represent approx

i

mate

l

y 79% o

f

t

h

e non-econom

i

c

vot

i

ng

i

nterests.

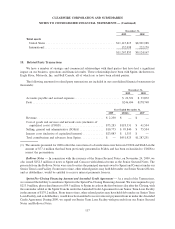

Warrants

A

ll

O

ld

C

l

earw

i

re warrants

i

ssue

d

an

d

outstan

di

ng at t

h

eC

l

os

i

ng were exc

h

ange

d

on a one-

f

or-one

b

as

i

s

f

or

w

arrants to purchase our Class A Common Stock with equivalent terms. The fair value of the warrants exchan

g

ed of

$

18.5 million is included in the calculation of purchase consideration using the Black-Scholes option pricing mode

l

using a share price of

$

6.62. Holders may exercise their warrants at any time, with exercise prices ranging fro

m

$3.00 to $48.00. Old Clearwire

g

ranted the holders of the warrants re

g

istration ri

g

hts coverin

g

the shares sub

j

ect t

o

i

ssuance under the warrants. The number of warrants outstanding at December 31, 2009 was 17,806,220. Th

e

w

arrants expire on August

5

, 2010, but the term is subject to extension in certain circumstances.

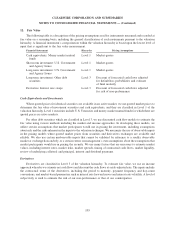

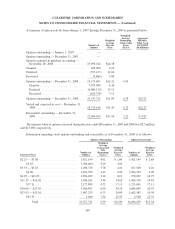

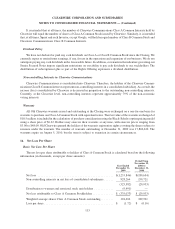

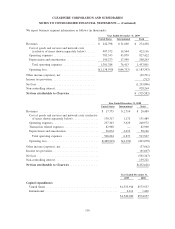

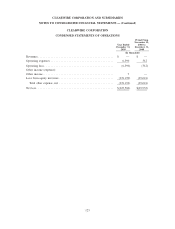

16. Net Loss Per

S

har

e

Basic Net Loss Per

Sh

are

T

he net loss per share attributable to holders of Class A Common Stock is calculated based on the followin

g

i

n

f

ormat

i

on (

i

nt

h

ousan

d

s, except per s

h

are amounts)

:

Yea

r

E

n

ded

December 31

,

2009

Period Fro

m

N

ovember 29,

2

008 t

o

D

ecember

31,

2008

N

et loss

...............................................

$

(1,253,846) $(189,654)

Non-contro

lli

n

gi

nterests

i

n net

l

oss o

f

conso

lid

ate

d

su

b

s

idi

ar

i

e

s

......

9

28

,

264 159

,

721

(

325,582

)(

29,933

)

D

i

str

ib

ut

i

on to warrant an

d

restr

i

cte

d

stoc

k

un

i

t

h

o

ld

er

s

...........

.

(

9,491

)—

N

et loss attributable to Class A Common Stockholder

s

............. $ (335,073) $ (29,933

)

We

i

g

h

te

d

average s

h

ares C

l

ass A Common Stoc

k

outstan

di

n

g

........

1

94

,

696 189

,

921

L

oss

p

er shar

e

...........................................

$

(

1.72

)$(

0.16

)

113

CLEARWIRE CORPORATION AND

S

UB

S

IDIARIE

S

N

OTES TO CONSOLIDATED FINANCIAL STATEMENTS —

(

Continued

)