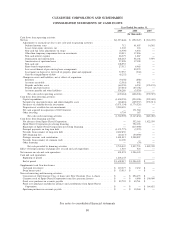

Clearwire 2009 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2009 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

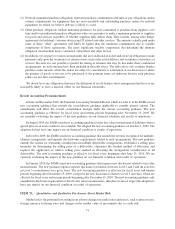

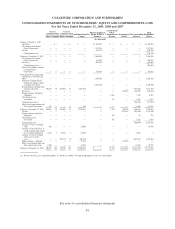

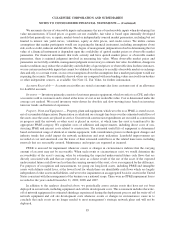

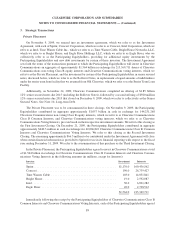

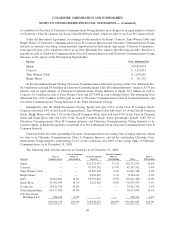

CLEARWIRE CORPORATION AND

S

UB

S

IDIARIE

S

CON

S

OLIDATED

S

TATEMENT

S

OF

S

TOCKHOLDER

S

’E

Q

UITY AND COMPREHEN

S

IVE LO

SS

For the Years Ended December

31, 2009, 2008

and

200

7

S

hares Amounts Shares Amount

s

C

lass

A

C

ommon

S

tock

C

lass

B

C

ommon

S

toc

k

A

dditional Paid I

n

C

ap

i

tal

Business E

q

uit

y

of

S

print WiMAX

B

us

i

nes

s

Accu

m

u

l

a

t

ed

O

the

r

Comprehensive

I

ncome

A

ccumulated

De

fi

c

i

t

Non-controllin

g

I

nterests

Tota

l

S

tockholders’

Equ

i

t

y

(

In thousands

)

Ba

l

ances at Januar

y

1, 2007

(

Ince

p

tion) . . . . . . . . . . . . — $— — $— $ — $ 1,402,410 $ — $ — $ — $ 1,402,410

N

et advances from Sprin

t

N

extel Cor

p

oration . . . . . . — — — — — 1,287,251 — — — 1,287,25

1

N

et loss . . . . . . . . . . . . . — — — — —

(

224,725

)

———

(

224,725

)

Com

p

re

h

ens

i

ve

l

oss . . . .

.

(224,725

)

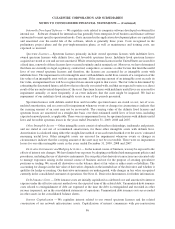

Balances at December 31, 2007. . — — — — — 2,464,936 — — — 2,464,93

6

N

et a

d

vances

f

rom Spr

i

n

t

N

extel Corporation . . . . . . — — — — — 4

5

1,92

5

———4

5

1,92

5

N

et loss

(

a

)

............ — — — — —

(

402,

6

93

)

———

(

402,

6

93

)

Comprehensive loss(a) . . . . — (402,

6

93

)

D

eferred tax liabilit

y

retained

by

Sprint Nextel

Cor

p

oration . . . . . . . . . . — — — — — 755,018 — — — 755,018

Total S

p

rint Nextel Cor

p

oratio

n

c

ontr

ib

ut

i

on at Novem

b

er 28,

2

008............... — — — — — 3,2

6

9,18

6

— — — 3,2

6

9,18

6

All

ocat

i

on o

f

Spr

i

nt Nexte

l

Corporat

i

on

b

us

i

ness equ

i

t

y

at closin

g

to Clearwire . . . . — — — — — (3,2

6

9,18

6

) — — — (3,2

6

9,18

6)

Recapitalization resultin

g

from

s

trate

g

ic transaction . . . . . 189,484 19

5

0

5

,000

5

1 2,092,00

5

—— —

5

,

5

7

5

,480 7,667,

555

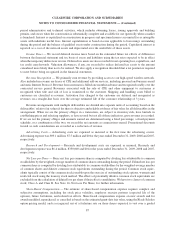

N

et loss

(

a

)

............ — — — — — — —

(

29,933

)(

159,721

)(

189,654

)

F

orei

g

n currenc

y

translatio

n

ad

j

ustment . . . . . . . . . . — — — — — — 2,682 — 7,129 9,811

Unrealized

g

ain o

n

investments . . . . . . . . . . — — — — — — 512 — 1

,

361 1

,

87

3

C

om

p

re

h

ens

i

ve

l

oss(a) . . . .

.

(

151,231) (177,970)

Sh

are-

b

ase

d

compensat

i

on an

d

o

ther capital transactions . . .

5

18 — — — 8

5

6 — — — 12,369 13,22

5

Balances at December 31, 2008. . 190,002 19

5

0

5

,000

5

1 2,092,861 — 3,194

(

29,933

)5

,436,618 7,

5

02,810

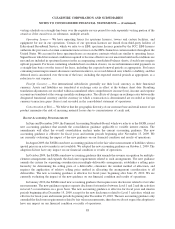

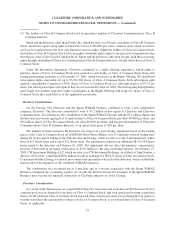

N

et loss . . . . . . . . . . . . . — — — — — —

(

32

5

,

5

82

)(

928,264

)(

1,2

5

3,846

)

F

orei

g

n currenc

y

translatio

n

ad

j

ustment . . . . . . . . . . — — — — — — 2

5

4 — 42 296

Unrealized

g

ain o

n

investments . . . . . . . . . . — — — — — — 297 — 1

,6

22 1

,

91

9

C

om

p

re

h

ens

i

ve

l

oss.......

(

926,600) (1,251,631

)

I

ssuance o

f

C

l

ass A common

s

tock . . . . . . . . . . . . .

5

88 — — — 10,000 — — — — 10,00

0

I

ssuance o

f

C

l

earw

i

re C

l

ass A

an

d

B common stoc

k

re

l

ate

d

to post-closin

g

ad

j

ustment . . 4,412 1 23,824 2 (33,

6

32) — — — 33,

6

32

3

I

ssuance o

f

C

l

ass B commo

n

s

tock

,

net of issuanc

e

costs . . . . . . . . . . . . . . — — 20

5

,41

5

20

(

140,2

5

3

)

— — — 1,622,043 1,481,810

Ri

g

hts offerin

g

— dividend . . . — — — — 57,541 — — (57,541) — —

S

hare-based com

p

ensation an

d

o

ther ca

p

ital transactions . . . 1,765 — — — 13,544 — — — 15,832 29,376

Balances at December 31, 2009. . 196,767

$

20 734,239

$

73

$

2,000,061

$

—

$

3,745

$(

413,056

)$

6,181,525

$

7,772,36

8

(a) Net loss for the year ended December 31, 2008 was (

$

592,347) and comprehensive loss was (

$

580,663)

.

S

ee notes to consolidated financial statements

81