Clearwire 2009 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2009 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ITEM

9.

Ch

an

g

es In an

d

Disa

g

reements wit

h

Accountants on Accountin

g

an

d

Financia

l

Disc

l

osure

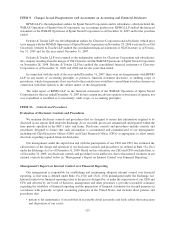

KPMG LLP is the inde

p

endent auditor for S

p

rint Nextel Cor

p

oration and its subsidiaries, which included the

Wi

MAX Operat

i

ons o

f

Spr

i

nt Nexte

l

Corporat

i

on, our account

i

ng pre

d

ecessor. KPMG LLP au

di

te

d

t

h

e

fi

nanc

i

a

l

s

tatements o

f

t

h

eW

i

MAX Operat

i

ons o

f

Spr

i

nt Nexte

l

Corporat

i

on as o

f

Decem

b

er 31, 2007 an

df

or t

h

e

y

ear t

h

en

e

nded

.

De

l

o

i

tte & Touc

h

e LLP was t

h

e

i

n

d

e

p

en

d

ent au

di

tor

f

or C

l

earw

i

re Cor

p

orat

i

on an

d

su

b

s

idi

ar

i

es (w

hi

c

hp

r

i

or

t

o its mer

g

er with the WiMAX Operations of Sprint Nextel Corporation on November 28, 2008 is referred to as Old

Clearwire

)

. Deloitte & Touche LLP audited the consolidated financial statements of Old Clearwire as of Decem-

b

er 31, 2007 an

df

or t

h

e

y

ear en

d

e

d

Decem

b

er 31, 2007

.

Deloitte & Touche LLP was retained as the inde

p

endent auditor for Clearwire Cor

p

oration and subsidiaries,

th

e company resu

l

t

i

ng

f

rom t

h

e merger o

f

O

ld

C

l

earw

i

re an

d

t

h

eW

i

MAX Operat

i

ons o

f

Spr

i

nt Nexte

l

Corporat

i

o

n

on November 28, 2008. Deloitte & Touche LLP has audited the consolidated financial statements of Clearwire

Corporation as of December 31, 2009 and 2008 and for the

y

ears then ended.

I

n connect

i

on w

i

t

h

t

h

eau

di

to

f

t

h

e

y

ear en

d

e

d

Decem

b

er 31, 2007, t

h

ere were no

di

sa

g

reements w

i

t

h

KPMG

LLP on an

y

matter of accountin

g

principles or practices, financial statement disclosure, or auditin

g

scope o

r

p

rocedures, which disa

g

reements if not resolved to their satisfaction would have caused them to make references in

c

onnect

i

on w

i

t

h

t

h

e

i

rop

i

n

i

on to t

h

esu

bj

ect matter o

f

t

h

e

di

sagreement

.

T

he audit re

p

ort of KPMG LLP on the financial statements of the WiMAX O

p

erations of S

p

rint Nextel

Corporat

i

on

f

or t

h

e year en

d

e

d

Decem

b

er 31, 2007

did

not conta

i

n any a

d

verse op

i

n

i

on or

di

sc

l

a

i

mer o

f

op

i

n

i

on, no

r

was

i

t qua

lifi

e

d

or mo

difi

e

d

as to uncerta

i

nt

y

,au

di

t scope, or account

i

n

g

pr

i

nc

i

p

l

es.

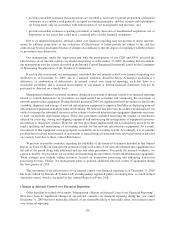

ITEM

9

A

.

C

ontrols and Procedures

E

valuation of Disclosure

C

ontrols and Procedures

We ma

i

nta

i

n

di

sc

l

osure contro

l

san

d

proce

d

ures t

h

at are

d

es

ig

ne

d

to ensure t

h

at

i

n

f

ormat

i

on requ

i

re

d

to

be

disclosed in our reports filed under the Exchan

g

e Act is recorded, processed, summarized and reported within th

e

t

ime periods specified in the SEC’s rules and forms. Disclosure controls and procedures include controls an

d

p

roce

d

ures

d

es

ig

ne

d

to ensure t

h

at suc

hi

n

f

ormat

i

on

i

s accumu

l

ate

d

an

d

commun

i

cate

d

to our mana

g

ement,

i

nc

l

u

di

n

g

our C

hi

e

f

Execut

i

ve O

ffi

cer (CEO) an

d

C

hi

e

f

F

i

nanc

i

a

l

O

ffi

cer (CFO), as appropr

i

ate, to a

ll

ow t

i

me

ly

decisions regarding required financial disclosure

.

Our mana

g

ement, under the supervision and with the participation of our CEO and CFO, has evaluated the

e

ffectiveness of the desi

g

n and operation of our disclosure controls and procedures (as defined in Rule 13a-1

5

(e

)

un

d

er t

h

e Exc

h

ange Act) as o

f

Decem

b

er 31, 2009. Base

d

on t

hi

seva

l

uat

i

on, our CEO an

d

CFO conc

l

u

d

e

d

t

h

at, as

o

f

Decem

b

er 31, 2009, our

di

sc

l

osure contro

l

san

dp

roce

d

ures were

i

ne

ff

ect

i

ve,

d

ue to t

h

e mater

i

a

l

wea

k

ness

i

nou

r

i

nternal controls described below in “Management’s Report on Internal Control over Financial Reporting.

”

M

anagement’s Report on Internal Control over Financial Reporting

Our management

i

s respons

ibl

e

f

or esta

bli

s

hi

ng an

d

ma

i

nta

i

n

i

ng a

d

equate

i

nterna

l

contro

l

over

fi

nanc

i

a

l

r

eportin

g

, as that term is defined under Rule 13a-15(e) and 15(d) -15(f) promul

g

ated under the Exchan

g

e Act

.

Internal control over financial reportin

g

refers to the process desi

g

ned b

y

, or under the supervision of, our CEO and

CFO an

d

e

ff

ecte

db

y our

b

oar

d

o

fdi

rectors, management an

d

ot

h

er personne

l

, to prov

id

e reasona

bl

e assurance

r

egar

di

ng t

h

ere

li

a

bili

ty o

ffi

nanc

i

a

l

report

i

ng an

d

t

h

e preparat

i

on o

ffi

nanc

i

a

l

statements

f

or externa

l

purposes

i

n

accordance with

g

enerall

y

accepted accountin

g

principles in the United States, and includes those policies an

d

p

roce

d

ures t

h

at

:

• perta

i

ntot

h

ema

i

ntenance o

f

recor

d

st

h

at

i

n reasona

bl

e

d

eta

il

accurate

ly

an

df

a

i

r

ly

re

fl

ect t

h

e transact

i

on

s

a

nd dis

p

osition of our assets;

12

5