Clearwire 2009 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2009 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Fi

nanc

i

n

g

Act

i

v

i

t

i

es

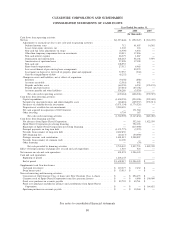

Net cash provided b

y

financin

g

activities was $2.75 billion for the

y

ear ended December 31, 2009. This is

p

rimarily due to

$

1.48 billion of cash received from the Private Placement,

$

2.47 billion received from the issuance

of the Senior Secured Notes and the Rollover Notes and $12.2 million in

p

roceeds from the issuance of shares of

Class A Common Stock to CW Investments Holdings LLC and proceeds from exercises of Class A Common Stoc

k

options. These are partially offset by payments of

$

1.17 billion on our Senior Term Loan Facility, which was retired

on Novem

b

er 24

,

2009

.

Our pa

y

ment obli

g

ations under the Senior Secured Notes and Rollover Notes are

g

uaranteed b

y

certai

n

domestic subsidiaries on a senior basis and secured b

y

certain assets of such subsidiaries on a first-priorit

y

lien. Th

e

S

en

i

or Secure

d

Notes an

d

Ro

ll

over Notes conta

i

n

li

m

i

tat

i

ons on our act

i

v

i

t

i

es, w

hi

c

h

among ot

h

er t

hi

ngs

i

nc

l

u

d

e

i

ncurrin

g

additional indebtedness and

g

uarantee indebtedness; makin

g

distributions or pa

y

ment of dividends or

c

ertain other restricted pa

y

ments or investments; makin

g

certain pa

y

ments on indebtedness; enterin

g

into a

g

ree

-

m

ents t

h

at restr

i

ct

di

str

ib

ut

i

ons

f

rom restr

i

cte

d

su

b

s

idi

ar

i

es; se

lli

ng or ot

h

erw

i

se

di

spos

i

ng o

f

assets; merger

,

c

onsolidation or sales of substantiall

y

all of our assets; enterin

g

transactions with affiliates; creatin

g

liens; issuin

g

c

ertain preferred stock or similar equit

y

securities and makin

g

investments and acquirin

g

assets. At December 31

,

2009, we were

i

n comp

li

ance w

i

t

h

our

d

e

b

t covenants.

Net cash provided b

y

financin

g

activities was $3.86 billion for the

y

ear ended December 31, 2008. This is

p

rimaril

y

due to $3.20 billion of cash received from the Investors, $532.2 million pre-transaction fundin

g

from

S

print and

$

392.2 million from the Sprint Pre-Closing Financing Amount, up through the Closing. These are

p

artiall

y

offset b

y

$213.0 million paid to Sprint for partial reimbursement of the pre-closin

g

financin

g

,a

$50.0 million debt financin

g

fee and a $3.6 million pa

y

ment on our Senior Term Loan Facilit

y

.

Net cash provided b

y

financin

g

activities was $1.02 billion for the

y

ear ended December 31, 2007. This was

due to advances from S

p

rint

.

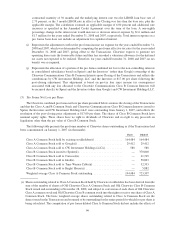

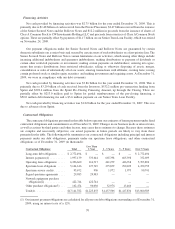

C

ontractual Obligation

s

Th

e contractua

l

o

bli

gat

i

ons presente

di

nt

h

eta

bl

e

b

e

l

ow represent our est

i

mates o

ff

uture payments un

d

er

fi

xe

d

c

ontractua

l

o

blig

at

i

ons an

d

comm

i

tments as o

f

Decem

b

er 31, 2009. C

h

an

g

es

i

n our

b

us

i

ness nee

d

sor

i

nterest rates

,

as well as actions b

y

third parties and other factors, ma

y

cause these estimates to chan

g

e. Because these estimate

s

are comp

l

ex an

d

necessar

il

ysu

bj

ect

i

ve, our actua

l

payments

i

n

f

uture per

i

o

d

s are

lik

e

l

y to vary

f

rom t

h

os

e

p

resente

di

nt

h

eta

bl

e. T

h

e

f

o

ll

ow

i

ng ta

bl

e summar

i

zes our contractua

l

o

bli

gat

i

ons

i

nc

l

u

di

ng pr

i

nc

i

pa

l

an

di

nterest

p

a

y

ments under our debt obli

g

ations, pa

y

ments under our spectrum lease obli

g

ations, and other contractual

o

bli

gat

i

ons as o

f

Decem

b

er 31, 2009 (

i

nt

h

ousan

d

s):

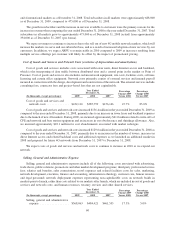

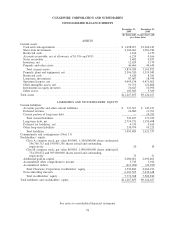

C

ontractual

O

bl

ig

at

i

ons Tota

l

Less Tha

n

1 Year 1 - 3 Years 3 - 5 Years

O

ver 5 Years

Lon

g

-term debt obli

g

ations . . . . .

$

2,772,494

$

—

$

—

$

—

$

2,772,494

Interest payments(1) . . . . . . . . . . 1,997,139 333,644 665,398 665,398 332,699

O

perating lease obligations . . . . . 6,496,660 214,717 441,279 446,768 5,393,89

6

Spectrum lease obligations . . . . .

5

,164,616 127,749 27

5

,879 290,229 4,470,7

5

9

S

p

ectrum service credits . . . . . . . 9

5

,672 986 1,972 1,973 90,741

Si

g

ned spectrum a

g

reements . . . . 29,983 29,983 — —

—

Network e

q

ui

p

ment

p

urchase

obli

g

ations(2) . . . . . . . . . . . . . 422,744 422,744 — — —

O

ther purchase obli

g

ations(3) . . . 162,474 96,030 52,978 13,466 —

Total

(

4

)

...................

$

17,141,782

$

1,225,853

$

1,437,506

$

1,417,834

$

13,060,589

(1) Our interest pa

y

ment obli

g

ations are calculated for all

y

ears on debt obli

g

ations outstandin

g

as of December 31

,

2009, using an interest rate of a 12%.

7

0