Classmates.com 2008 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2008 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Cash flows from financing activities were also negatively impacted by the withholding of a portion of shares underlying the restricted stock

units we award to employees. Upon vesting, we did not collect the applicable employee withholding taxes for restricted stock units from

employees. Instead, we automatically withheld, from the restricted stock units that vest, the portion of those shares with a fair market value equal

to the amount of the employee withholding taxes due. We then paid the applicable withholding taxes in cash. The net effect of such withholding

adversely impacted our cash flows from financing activities. The amounts remitted in the years ended December 31, 2007 and 2006 were

$5.6 million and $2.7 million, respectively, for which we withheld 390,000 shares and 215,000 shares of common stock, respectively, that were

underlying the restricted stock units.

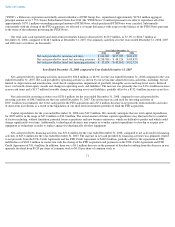

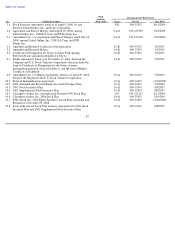

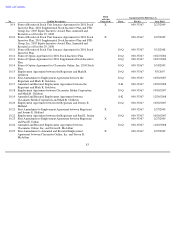

Contractual Obligations

Contractual obligations at December 31, 2008 were as follows (in thousands):

(1)

Total

Less than

1 Year

1 Year to

Less than

3 Years

3 Years to

Less than

5 Years

More than

5 Years

Operating leases(1)

$

64,736

$

16,424

$

21,587

$

14,157

$

12,568

Services and promotional contracts

8,111

6,059

2,052

—

—

Telecommunications purchases

2,053

1,144

909

—

—

Media purchases

2,502

2,477

25

—

—

Floral

-

related purchase obligations

2,473

2,246

227

—

—

Debt, including interest

582,776

50,924

107,206

123,993

300,653

Member redemption liability, long

-

term

5,231

—

5,231

—

—

Other long

-

term liabilities

2,771

438

1,440

263

630

Total

$

670,653

$

79,712

$

138,677

$

138,413

$

313,851

The operating lease obligations shown in the table have not been reduced by minimum non

-

cancelable sublease rentals aggregating

$1.5 million. We remain secondarily liable under these leases in the event that any sublessee defaults under the sublease terms. We do not

believe that material payments will be required as a result of our secondary responsibilities.

At December 31, 2008, we had gross unrealized tax benefits of approximately $11.8 million, all of which, if recognized, would have an

impact on our effective tax rate.

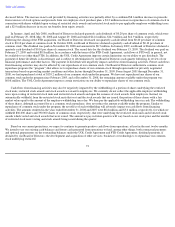

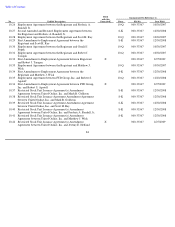

Commitments under standby letters of credit at December 31, 2008 are scheduled to expire as follows (in thousands):

Standby letters of credit are maintained pursuant to certain of our lease arrangements. The standby letters of credit remain in effect at

declining levels through the terms of the related leases. In addition, standby letters of credit are maintained by FTD to secure credit card

processing activity.

Other Commitments

In the ordinary course of business, we may provide indemnifications of varying scope and terms to customers, vendors, lessors, business

partners, and other parties with respect to certain matters, including, but not limited to, losses arising out of our breach of such agreements,

services to be provided by us, or from intellectual property infringement claims made by third-parties. In addition, we have entered into

indemnification agreements with our directors and certain of our officers and

74

Total

Less than

1 Year

1 Year to

Less than

3 Years

3 Years to

Less than

5 Years

More than

5 Years

Standby letters of credit

$

12,929

$

11,805

$

882

$

242

$

—