Classmates.com 2008 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2008 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

year ended December 31, 2007. FTD sales and marketing expenses as a percentage of FTD revenues decreased to 16.1% for the year ended

December 31, 2008, compared to 16.7% for the prior year period. Excluding the impact of foreign currency exchange rates, sales and marketing

costs decreased by $3.5 million. The decrease was due to reduced costs in certain programs, including online marketing and reduced florist

member incentives, partially offset by increased direct marketing costs.

FTD Technology and Development Expenses. FTD technology and development expenses decreased by $7.5 million, or 29.3%, to

$18.2 million, for the year ended December 31, 2008, compared to $25.7 million, for the year ended December 31, 2007. FTD technology and

development expenses as a percentage of FTD revenues decreased to 2.9% for the year ended December 31, 2008, compared to 4.0% for the

prior year period. Excluding the impact of foreign currency exchange rates, technology and development costs decreased by $6.9 million. The

decrease was primarily driven by reduced costs for third-party services and personnel and related costs for technology development.

FTD General and Administrative Expenses. FTD general and administrative expenses increased by $22.1 million, or 62.4%, to

$57.6 million, for the year ended December 31, 2008, compared to $35.5 million for the year ended December 31, 2007. FTD general and

administrative expenses as a percentage of FTD revenues increased to 9.3% for the year ended December 31, 2008, compared to 5.6% for the

prior year period. Excluding the impact of foreign currency exchange rates, general and administrative costs increased by $22.4 million. The

increase was primarily due to the inclusion of $16.2 million of costs related to the acquisition of FTD in August 2008. In addition, FTD incurred

charges of $2.0 million related to acquisition opportunities that were abandoned in light of the pending acquisition. The increase related to these

costs was partially offset by reduced personnel and related costs and the reversal of a deferred compensation accrual upon the departure of a

member of FTD's management.

FTD Impairment of Goodwill, Intangible Assets and Long-Lived Assets. FTD impairment charges totaled $175.9 million for the year

ended December 31, 2008, compared to $0 for the year ended December 31, 2007. Impairment charges for the year ended December 31, 2008

were due to a reduction in the fair value of the FTD reporting unit compared to its carrying value and lower fair values in the FTD and Interflora

trademarks and trade names compared to their carrying values.

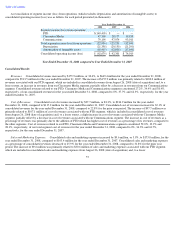

Year Ended December 31, 2007 compared to Year Ended December 31, 2006

Consolidated Results

Revenues. Consolidated services revenues decreased by $44.0 million, or 10%, to $379.5 million for the year ended December 31, 2007,

compared to $423.6 million for the year ended December 31, 2006. The decrease in services revenues for the year ended December 31, 2007 was

due to a decrease in revenues from our Communications segment, partially offset by an increase in revenues from our Classmates Media

segment. Services revenues related to our Classmates Media segment and our Communications segment constituted 28.1% and 71.9%,

respectively, of our consolidated services revenues for the year ended December 31, 2007, compared to 19.2% and 80.8%, respectively, for the

year ended December 31, 2006. Consolidated advertising revenues increased by $34.9 million, or 35%, to $134.0 million for the year ended

December 31, 2007, compared to $99.1 million for the year ended December 31, 2006. The increase was primarily attributable to an increase in

advertising revenues in our Classmates Media segment and, to a lesser extent, also our Communications segment. Advertising revenues related

to our Classmates Media segment and our Communications segment constituted 64.9% and 35.1%, respectively, of our consolidated advertising

revenues for the year ended December 31, 2007, compared to 58.8% and 41.2%, respectively, for the year ended December 31, 2006.

64