Classmates.com 2008 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2008 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

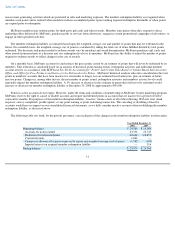

market comparison approaches. Some of the more significant estimates and assumptions inherent in the two approaches include: projected future

cash flows (including timing); discount rate reflecting the risk inherent in the future cash flows; terminal growth rate; subscriber churn; terminal

value; determination of appropriate market comparables; and the determination of whether a premium or a discount should be applied to market

comparables. Most of the above assumptions are made based on available historical and market information.

Goodwill and Indefinite-Lived Intangible Assets

Goodwill represents the excess of the purchase price of an acquired entity over the fair value of the net tangible and intangible assets

acquired. Indefinite-lived intangible assets acquired in a business combination are initially recorded at management's estimate of their fair

values. We account for goodwill and indefinite-lived intangible assets in accordance with SFAS No. 142, Goodwill and Other Intangible Assets

,

which among other things, addresses financial accounting and reporting requirements for acquired goodwill and indefinite-lived intangible

assets. SFAS No. 142 prohibits the amortization of goodwill and requires us to test goodwill and indefinite-

lived intangible assets for impairment

at least annually at the reporting unit level.

We test the goodwill of our reporting units and indefinite-lived intangible assets for impairment annually during the fourth quarter of our

fiscal year and whenever events occur or circumstances change that would more likely than not indicate that the goodwill and/or indefinite-lived

intangible assets might be permanently impaired. Events or circumstances which could trigger an impairment review include, but are not limited

to, a significant adverse change in legal factors or in the business climate, an adverse action or assessment by a regulator, unanticipated

competition, a loss of key management or other personnel, significant changes in the manner of our use of the acquired assets or the strategy for

the acquired business or our overall business, significant negative industry or economic trends or significant underperformance relative to

expected historical or projected future results of operations.

The determination of whether or not goodwill is impaired involves a significant level of judgment in the assumptions underlying the

approaches used to determine the estimated fair values of our reporting units. The determination of the fair values of our reporting units

generally includes a study of market comparables, including the selection of appropriate valuation multiples and discounted cash flow models

based on our internal forecasts and projections. In connection with the impairment assessment we performed in the quarter ended December 31,

2008, given the volatility of the capital markets around the valuation date, a study of market transactions and their transaction multiples was not

utilized. The estimated fair value of each of our reporting units is determined using a combination of the income approach and the market

approach.

Indefinite

-Lived Intangible Assets

Testing indefinite-lived intangible assets, other than goodwill, for impairment requires a one-step approach under SFAS No. 142. We test

indefinite-lived intangible assets for impairment on an annual basis, or more frequently, if events occur or circumstances change that indicate

they may be impaired. The fair values of indefinite-lived intangible assets are compared to their carrying values and if the carrying amount of

indefinite-lived intangible assets exceeds the fair value, an impairment loss is recognized equal to the excess.

The process of estimating the fair value of indefinite-lived intangible assets is subjective and requires us to make estimates that may

significantly impact the outcome of the analyses. Such estimates include, but are not limited to, future operating performance and cash flows,

cost of capital, terminal values, and remaining economic lives of assets.

47