Classmates.com 2008 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2008 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

UNITED ONLINE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

10. STOCK-BASED COMPENSATION PLANS (Continued)

The number of restricted stock units to be issued for each exchanged underwater stock option will be determined in accordance with a 1-

for-3 exchange ratio. A total of 2.0 million underwater stock options are eligible for the exchange, for which 0.6 million restricted stock units

would be issued if all underwater stock options are exchanged. All underwater stock options will be canceled upon exchange for restricted stock

units pursuant to the Company's 2001 Stock Incentive Plan.

The restricted stock units will vest in quarterly increments over two years measured from February 15, 2009, subject to the officer's

continued employment with the Company through the vesting date of such restricted stock units. Upon vesting, the Company will issue shares of

common stock corresponding to the number of vested restricted stock units awarded to the officer, less the number of shares having an aggregate

value equal to the Company's statutory withholding obligations with respect to applicable federal and state income and employment withholding

taxes (all as consistent with the Company's current practices with respect to restricted stock units).

Employee Stock Purchase Plan

The Company has an employee stock purchase plan, which expires in 2011, and under which 7.7 million shares of the Company's common

stock were reserved for issuance under the plan at December 31, 2008. At December 31, 2008, 3.5 million shares were available for issuance.

Under the employee stock purchase plan, each eligible employee may authorize payroll deductions of up to 15% of their compensation to

purchase shares of common stock on two purchase dates each year at a purchase price per share equal to 85% of the lower of (i) the closing

market price per share of the Company's common stock on the employee's entry date into the two-year offering period in which the purchase

date occurs or (ii) the closing market price per share on the purchase date. Each offering period has a 24-month duration and purchase intervals

of six months.

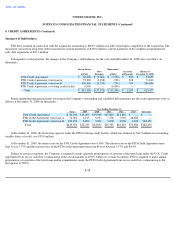

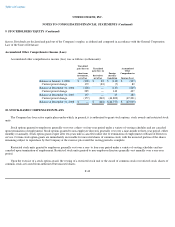

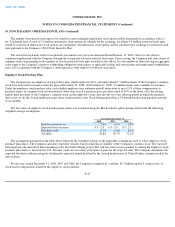

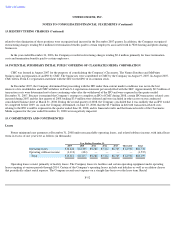

The fair value of employee stock purchase plan shares was estimated using the Black-Scholes option pricing model with the following

weighted-average assumptions:

The assumptions presented in the table above represent the weighted average of the applicable assumptions used to value employee stock

purchase plan shares. The Company calculates expected volatility based on historical volatility of the Company's common stock. The expected

term represents the amount of time remaining in the 24-month offering period. The risk-free interest rate assumed in valuing the employee stock

purchase plan shares is based on the U.S. Treasury yield curve in effect at the time of grant for the expected term. The Company determines the

expected dividend yield percentage by dividing the expected annual dividend by the closing market price of United Online common stock at the

date of grant.

For the years ended December 31, 2008, 2007 and 2006, the Company recognized $1.1 million, $1.7 million and $1.9, respectively, of

stock-based compensation related to the employee stock purchase

F-47

Year Ended December 31,

2008

2007

2006

Risk

-

free interest rate

2.4

%

4.5

%

3.8

%

Expected term (in years)

0.5

-

2.0

0.5

-

2.0

0.5

-

2.0

Dividend yield

6.3

%

6.4

%

8.3

%

Volatility

43.8

%

38.7

%

52.1

%