Classmates.com 2008 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2008 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Impairment of Indefinite

-Lived Intangible Assets

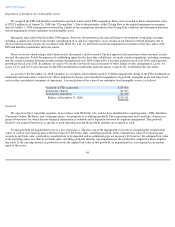

We acquired the FTD and Interflora trademarks and trade names in the FTD acquisition. These were recorded at their estimated fair value

of $229.8 million as of August 26, 2008 (the "Closing Date"). Due to the proximity of the Closing Date to the annual impairment assessment

date of October 1, 2008, management reviewed the validity of the assumptions included in the Closing Date valuation and determined that there

was no impairment of these indefinite-lived intangible assets.

During the latter half of the December 2008 quarter, there was deterioration in the general business environment, weakening consumer

spending, a significant decline in the market capitalization of us and our competitors, and a decline in our business outlook primarily due to

adverse macroeconomic factors. In accordance with SFAS No. 142, we performed an interim impairment assessment of the fair values of the

FTD and Interflora trademarks and trade names.

These assets are valued using a relief-from-royalty discounted cash flow model. The key inputs for this model are future revenues, royalty

rate and discount rate. Solely for purposes of establishing inputs for the fair value calculations, we made certain assumptions, including assuming

that the current economic downturn would continue through fiscal year 2009, followed by a recovery period in fiscal year 2010, and long-term

growth past fiscal year 2010. In addition, we used a 4% royalty rate based on an assessment of other similar royalty arrangements. Lastly, we

used a 14.6% and 16.5% discount rate for the FTD and Interflora trademarks and trade names, respectively, to determine the fair values.

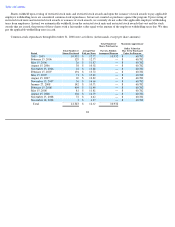

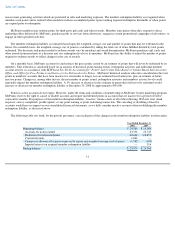

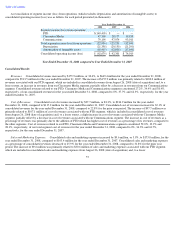

As a result of the December 31, 2008 valuation, we recorded a $44.0 million and $17.9 million impairment charge of the FTD and Interflora

trademarks and trade names, respectively. These impairment charges were included in impairment of goodwill, intangible assets and long-lived

assets in the consolidated statements of operations. A reconciliation of the value of our indefinite-lived intangible assets is as follows:

Goodwill

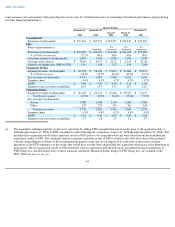

We operate in three reportable segments, in accordance with SFAS No. 131, and we have identified five reporting units—FTD, Interflora,

Classmates Online, MyPoints, and Communications—for purposes of evaluating goodwill. These reporting units each constitute a business or

group of businesses for which discrete financial information is available and is regularly reviewed by segment management. The goodwill

related to our acquired businesses is specific to each reporting unit and the goodwill amounts are assigned as such.

Testing goodwill for impairment involves a two-step process. The first step of the impairment test involves comparing the estimated fair

values of each of our reporting units with their respective net book values, including goodwill. If the estimated fair value of a reporting unit

exceeds its net book value, goodwill is considered not to be impaired and no additional steps are necessary. If, however, the estimated fair value

of the reporting unit is less than its net book value, including goodwill, then the carrying amount of the goodwill is compared with its implied

fair value. If the carrying amount of goodwill exceeds the implied fair value of that goodwill, an impairment loss is recognized in an amount

equal to the excess.

48

Acquired in FTD acquisition

$

229,800

Impairment charges

(61,867

)

Translation adjustment

(14,419

)

Balance at December 31, 2008

$

153,514