Classmates.com 2008 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2008 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

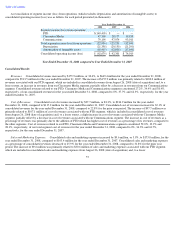

Impairment of Goodwill

We performed our annual impairment assessment of goodwill as of October 1, 2008 and determined that goodwill at our Classmates,

MyPoints and Communications reporting units was not impaired. Due to the proximity of the Closing Date to the annual impairment assessment

date of October 1, 2008, management reviewed the validity of the assumptions included in the Closing Date valuation and determined that there

was no impairment of the FTD and Interflora reporting units as of October 1, 2008.

During the latter half of the December 2008 quarter, there was deterioration in the general business environment, weakening consumer

spending, a significant decline in the market capitalization of us and our competitors and a decline in our business outlook primarily due to

adverse macroeconomic factors. In accordance with SFAS No. 142, we considered whether these factors and circumstances made it more likely

than not that any of our reporting units would have a fair value less than carrying value and an interim impairment assessment should be

performed. As a result of this review, we concluded that an interim impairment assessment as of December 31, 2008 should be performed for our

FTD and Interflora reporting units. Due to the significant excess of fair value over carrying value of the Classmates, MyPoints and

Communications reporting units at the annual impairment assessment date, we determined that an interim impairment assessment was not

required for these reporting units. However, in order to validate the overall enterprise valuation, we performed an updated valuation of these

reporting units at December 31, 2008.

The estimated fair values for all of our reporting units were determined using a combination of the income approach and the market

approach. Under the income approach, a reporting unit's fair value is estimated based on the discounted cash flow method. The discounted cash

flow method is dependent upon a number of factors, including projections of the amounts and timing of future revenues and cash flows, assumed

discount rates and other assumptions. Under the market approach, using the guideline company method, a reporting unit's fair value is estimated

based on multiples of the cash-free market value of invested capital to revenue and EBITDA of the guideline companies. The revenue and

EBITDA multiples of our reporting units were selected based on a comparison of each reporting unit's operating performance and margins,

among other factors, to those of the guideline companies.

In arriving at the final estimated fair values of each of the reporting units, the estimated fair values as calculated under both the income

approach and the market approach were multiplied by a weighting factor, the sum of which was the final estimated fair value. The income

approach was weighted 75% and the market approach was weighted 25%. The income approach was weighted more heavily as the data included

in that method is based on our projections and forecasts whereas the market approach was weighted less heavily as the guideline companies used

in those models are not 100% comparable to our reporting units.

Solely for purposes of establishing inputs for the fair value calculations described above related to interim goodwill impairment testing of

the FTD and Interflora reporting units, we made certain assumptions, including that the current economic downturn would continue through

fiscal year 2009, followed by a recovery period in fiscal year 2010, and long-term growth past fiscal year 2010. In addition, we applied margin

and other cost assumptions consistent with the reporting unit's historical trends at various revenue levels and used a 3% growth factor to

calculate the terminal value of our reporting units. We used a 14.1% and 16.0% discount rate for the FTD and Interflora reporting units,

respectively, to calculate the fair values of these reporting units. The sum of the fair values of the reporting units was reconciled to our current

market capitalization (based upon our stock price) plus an estimated control premium.

As a result of the aforementioned factors, we recorded an impairment charge of $114.0 million related to goodwill within the FTD reporting

unit. These impairment charges were included in impairment of goodwill, intangible assets and long-lived assets in the consolidated statements

of

49