Classmates.com 2008 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2008 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

UNITED ONLINE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

7. DERIVATIVE INSTRUMENT

In November 2008, the Company entered into a three-year interest rate cap instrument to manage risks associated with interest rate

fluctuations on a $150 million notional amount of the FTD Credit Agreement which is accounted for as a cash flow hedge at December 31, 2008.

At December 31, 2008, the cap had a fair value of $40,000. This derivative instrument was included in other assets in the consolidated balance

sheet at December 31, 2008 and the interest rate cap was determined to be highly effective.

In January 2009, the Company decided to change the interest rate basis of the hedged item from LIBOR-based to prime-based and, as a

result, the cash flow hedge was de-designated and, while so de-designated, does not qualify for hedge accounting treatment.

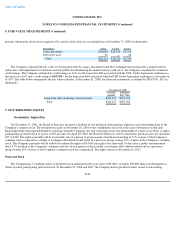

8. FAIR VALUE MEASUREMENTS

On January 1, 2008, the Company adopted certain provisions of SFAS No. 157, Fair Value Measurements , which establishes a single

authoritative definition of fair value, sets out a framework for measuring fair value and expands on required disclosures about fair value

measurement. The provisions of SFAS No. 157 relate to financial assets and liabilities as well as other assets and liabilities carried at fair value

on a recurring basis and did not have a material impact on the Company's consolidated financial statements. The provisions of SFAS No. 157

related to nonfinancial assets and liabilities will be effective for the Company on January 1, 2009 in accordance with FSP FAS 157-2, Effective

Date of FASB Statement No. 157

and will be applied prospectively. The Company is currently evaluating the impact that these additional

provisions will have on the Company's consolidated financial statements. In accordance with FSP FAS 157-2, the Company will apply the

provisions of SFAS No. 157 to property and equipment, goodwill and intangible assets at January 1, 2009.

On January 1, 2008, SFAS No. 159, The Fair Value Option for Financial Assets and Financial Liabilities—including an Amendment of

FASB Statement No. 115

, became effective. SFAS No. 159 allows an entity to choose to measure certain financial instruments and liabilities at

fair value on its balance sheet on a contract-by-contract basis. The Company has elected not to adopt the fair value option of SFAS No. 159 on

its existing financial instruments.

In October 2008, the FASB issued FSP FAS 157-3, Determining the Fair Value of a Financial Asset When the Market for That Asset Is Not

Active

, to clarify how an entity would determine fair value in an inactive market. FSP FAS 157-3 was effective immediately and applied to the

Company's consolidated financial statements for the year ended December 31, 2008. The application of the provisions of FSP FAS 157-

3 did not

materially impact the Company's consolidated financial statements.

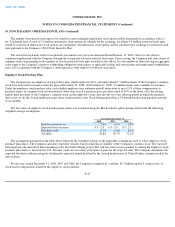

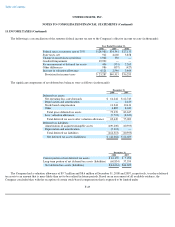

SFAS No. 157 establishes a three-tiered hierarchy that draws a distinction between market participant assumptions based on (i) quoted

prices (unadjusted) in active markets for identical assets and liabilities (Level 1), (ii) inputs other than quoted prices in active markets that are

observable either directly or indirectly (Level 2) and (iii) unobservable inputs that require the Company to use present value and other valuation

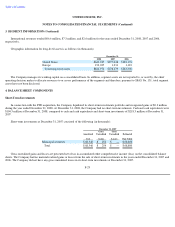

techniques in the determination of fair value (Level 3). The following table

F-39