Classmates.com 2008 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2008 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

UNITED ONLINE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

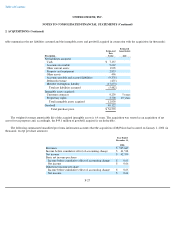

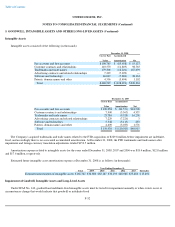

5. GOODWILL, INTANGIBLE ASSETS AND OTHER LONG-LIVED ASSETS (Continued)

intangible assets might be permanently impaired. Under SFAS No. 144, identifiable intangible assets and other long-lived assets, other than

indefinite-lived intangible assets, must be tested for impairment when events occur or circumstances change that would indicate the carrying

amount of an asset may not be recoverable.

Impairment of Indefinite

-Lived Intangible Assets

2008 Impairment Charge

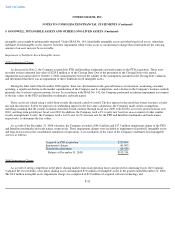

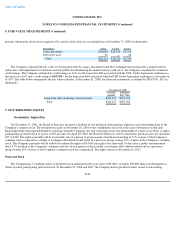

As discussed in Note 2, the Company acquired the FTD and Interflora trademarks and trade names in the FTD acquisition. These were

recorded at their estimated fair value of $229.8 million as of the Closing Date. Due to the proximity of the Closing Date to the annual

impairment assessment date of October 1, 2008, management reviewed the validity of the assumptions included in the Closing Date valuation

and determined that there was no impairment of these indefinite-lived intangible assets.

During the latter half of the December 2008 quarter, there was deterioration in the general business environment, weakening consumer

spending, a significant decline in the market capitalization of the Company and its competitors, and a decline in the Company's business outlook

primarily due to adverse macroeconomic factors. In accordance with SFAS No. 142, the Company performed an interim impairment assessment

of the fair values of the FTD and Interflora trademarks and trade names.

These assets are valued using a relief-from-royalty discounted cash flow model. The key inputs for this model are future revenues, royalty

rate and discount rate. Solely for purposes of establishing inputs for the fair value calculations, the Company made certain assumptions,

including assuming that the current economic downturn would continue through fiscal year 2009, followed by a recovery period in fiscal year

2010, and long-term growth past fiscal year 2010. In addition, the Company used a 4% royalty rate based on an assessment of other similar

royalty arrangements. Lastly, the Company used a 14.6% and 16.9% discount rate for the FTD and Interflora trademarks and trade names,

respectively, to determine the fair values.

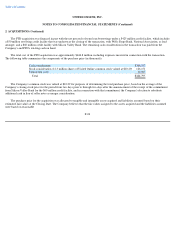

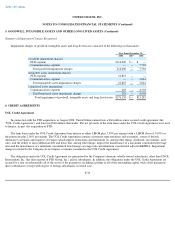

As a result of the December 31, 2008 valuation, the Company recorded a $44.0 million and $17.9 million impairment charge of the FTD

and Interflora trademarks and trade names, respectively. These impairment charges were included in impairment of goodwill, intangible assets

and long-lived assets in the consolidated statements of operations. A reconciliation of the value of the Company's indefinite-lived intangible

assets is as follows:

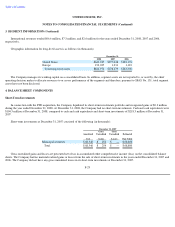

2006 Impairment Charge

As a result of strong competition in the photo sharing market, historical operating losses and projected continuing losses, the Company

evaluated the recoverability of its photo sharing assets and impaired $3.0 million of intangible assets in the quarter ended December 31, 2006.

The $3.0 million intangible assets impairment charge was comprised of $2.9 million of acquired software technology and

F-33

Acquired in FTD acquisition

$

229,800

Impairment charges

(61,867

)

Translation adjustment

(14,419

)

Balance at December 31, 2008

$

153,514