Classmates.com 2008 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2008 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226

|

|

Table of Contents

UNITED ONLINE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

11. INCOME TAXES (Continued)

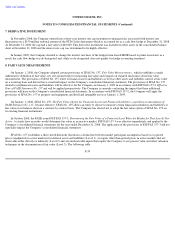

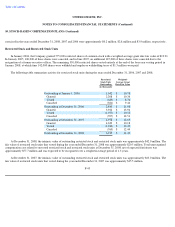

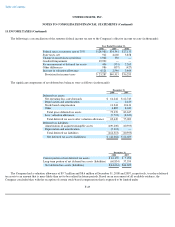

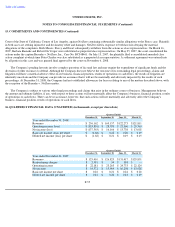

The following is a reconciliation of the statutory federal income tax rate to the Company's effective income tax rate (in thousands):

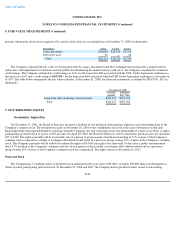

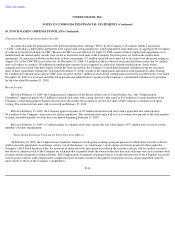

The significant components of net deferred tax balances were as follows (in thousands):

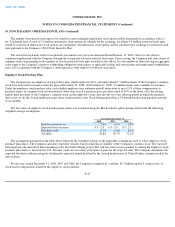

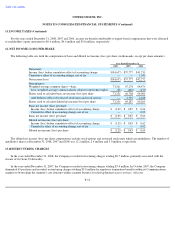

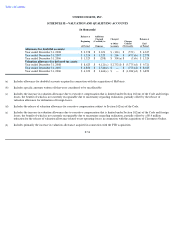

The Company had a valuation allowance of $9.7 million and $8.6 million at December 31, 2008 and 2007, respectively, to reduce deferred

tax assets to an amount that is more likely than not to be realized in future periods. Based on an assessment of all available evidence, the

Company concluded that, with the exception of certain stock-based compensation that is expected to be limited under

F-49

Year Ended December 31,

2008

2007

2006

Federal taxes at statutory rate of 35%

$

(24,980

)

$

34,541

$

27,133

State taxes, net

912

4,660

3,858

Change in uncertain tax positions

1,942

336

—

Goodwill impairment

39,900

—

—

Re

-

measurement of deferred tax assets

406

(331

)

2,265

Other differences

986

(837

)

(427

)

Increase in valuation allowance

4,121

2,546

3,464

Provision for income taxes

$

23,287

$

40,915

$

36,293

December 31,

2008

2007

Deferred tax assets:

Net operating loss carryforwards

$

61,242

$

62,743

Depreciation and amortization

—

2,429

Stock

-

based compensation

11,243

10,411

Other

6,885

8,042

Total gross deferred tax assets

79,370

83,625

Less: valuation allowance

(9,721

)

(8,623

)

Total deferred tax assets after valuation allowance

69,649

75,002

Deferred tax liabilities:

Amortization of acquired intangible assets

(109,200

)

(10,393

)

Depreciation and amortization

(5,113

)

—

Total deferred tax liabilities

(114,313

)

(10,393

)

Net deferred tax assets (liabilities)

$

(44,664

)

$

64,609

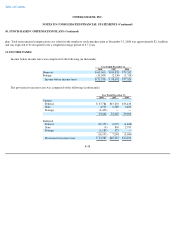

December 31,

2008

2007

Current portion of net deferred tax assets

$

16,170

$

7,050

Long

-

term portion of net deferred tax assets (liabilities)

(60,834

)

57,559

Net deferred tax assets (liabilities)

$

(44,664

)

$

64,609