Classmates.com 2008 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2008 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

of Directors to decide to cease the payment of, or further reduce, dividends in the future. We cannot assure you that we will not decrease or

discontinue quarterly cash dividends, and if we do, our stock price could be negatively impacted.

We have anti-takeover provisions that may make it difficult for a third-party to acquire us.

Provisions of our certificate of incorporation, our bylaws and Delaware law could make it difficult for a third-party to acquire us, even if

doing so might be beneficial to our stockholders because of a premium price offered by a potential acquirer. Our Board of Directors adopted a

stockholder rights plan, which is an anti-takeover measure that will cause substantial dilution to a third-party who attempts to acquire our

Company on terms not approved by our Board of Directors.

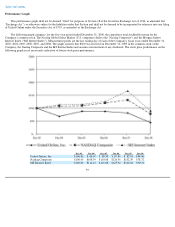

Our stock price has been highly volatile and may continue to be volatile.

The market price of our common stock has fluctuated significantly and it may continue to be volatile with extreme trading volume

fluctuations. In addition, The Nasdaq Global Select Market, where most publicly-

held Internet companies are traded, has experienced substantial

price and trading volume fluctuations. The broad market and industry factors that influence or affect such fluctuations may harm the market

price of our common stock, regardless of our actual operating performance. As a result of these or other reasons, we have experienced and may

continue to experience significant declines in the market price of our common stock.

ADDITIONAL RISKS RELATING TO OUR FTD SEGMENT

Competition could have a material adverse effect on our business, financial condition, results of operations, and cash flows.

We compete in the market for flowers and, to a lesser degree, specialty gifts. In the consumer market, consumers are our customers for

direct sales of floral and specialty gifts through our Web sites and toll-

free telephone numbers. In the floral services market, retail florists are our

customers for memberships and subscriptions to our various floral network services including, among other things, access to the FTD and

Interflora brands and the Mercury Man logo, access to the florist network, credit card processing services, e-commerce Web sites, online

advertising tools, and telephone answering and order-taking services.

The consumer market for flowers and specialty gifts is highly competitive, and consumers can purchase the products we offer from

numerous sources, including traditional retail florists, supermarkets, specialty gift retailers and large nationwide floral marketers, such as those

that use Web sites, toll-free telephone numbers and catalogs. The floral network services market is highly competitive as well, and retail florists

may choose from a few floral service providers that offer similar products and services. In the U.S., our key competitors in the consumer market

include 1-800-FLOWERS.COM, Inc. and Proflowers.com, and our key competitors in the floral services market include Teleflora and

BloomNet Wire Service, a subsidiary of 1-800-FLOWERS.COM. International key competitors include Marks & Spencer, NEXT, John Lewis,

Teleflorist, and Flowers Direct.

We believe competition in the consumer market will likely intensify. Supermarkets and nationwide floral marketers have been gaining

market share over retail florists as consumers continue to shift more of their floral purchases to these channels. We expect the sales volumes at

supermarkets and other mass market retailers to continue to increase, and other nationwide floral marketers will continue to increase their

competition with us. In particular, the nature of the Internet as a marketplace facilitates competitive entry and comparative shopping, and we

have experienced increased competition based on price. Some of our competitors may have significant competitive advantages over us, may

devote significantly greater resources to marketing campaigns or other aspects of their business or may respond more quickly and effectively

than we can to new or changing opportunities or customer requirements.

29