Cincinnati Bell 2014 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2014 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Form 10-K Part I

Cincinnati Bell Inc.

CyrusOne is a real estate investment trust ("REIT") that conducts its data center business through CyrusOne LP, an operating partnership. Cincinnati Bell

owns approximately 44% of the economic interests of CyrusOne (NASDAQ: CONE), through the ownership of 1.9 million shares of CyrusOne's common

stock and 26.6 million partnership units of CyrusOne LP. At December 31, 2014, the fair value of this investment was $785.0 million based on the quoted

market price of CyrusOne's common stock.

Sales and Distribution Channels

The Company’s Wireline and Wireless segments utilize a number of distribution channels to acquire customers. Subsequent to the agreement to sell our

wireless spectrum, we significantly reduced our sales effort for wireless service and products and rebranded our retail stores to market and distribute our

Fioptics suite of products. As of December 31, 2014, the Company operated eight retail stores in its operating territory, up from seven in the prior year. The

Company works to locate retail stores in high traffic but affordable areas, with a distance between each store that considers optimal returns per store and

customer convenience. The Company also offers fully-automated, end-to-end web-based sales of various other Company services and accessories. In

addition, the Company utilizes a door-to-door sales force that targets the sale of Fioptics to residents.

During 2014, there were approximately 130 third-party agent locations that sold Wireline and Wireless products and services at their retail locations. The

Company supported these agents with discounted prices for equipment and commission structures. In conjunction with the completion of the wireless

spectrum sale on September 30, 2014, the Company has discontinued third-party agent relationships. The Company also sells wireline capacity on a

wholesale basis to independent companies, including competitors that resell these services to end-users.

Within each segment, we utilize a business-to-business sales force and a call center organization to reach business customers in our operating territory. Larger

business customers are often supported by sales account representatives, who may go to the customer premises to understand the business needs and

recommend solutions the Company offers. Smaller business customers are supported through a telemarketing sales force, customer representatives and store

locations.

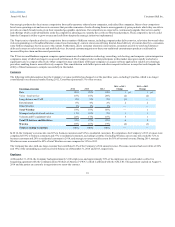

Suppliers and Product Supply Chain

The Company generally subjects purchases to competitive bids and selects its vendors based on price, service level, delivery, quality of product and terms

and conditions.

Wireline’s primary purchases are for network equipment, software, and fiber cable to maintain and support the growth of Fioptics, as well as copper-based

electronics and cable. The Company maintains facilities and operations for storing cable and other equipment, product distribution and customer fulfillment.

IT Services and Hardware primarily purchases IT and telephony equipment that is either sold to a customer or used to provide service to the customer. The

Company is a certified distributor of Cisco, EMC, Avaya, and Oracle equipment. Most of this equipment is shipped directly to the customer from vendor

locations but the Company does maintain warehouse facilities for replacement parts and equipment testing and staging.

In addition, we have long-term commitments to outsource various services, such as certain information technology functions, cash remittance and accounts

payable functions, call center operations, and maintenance services.

Competition

The telecommunications industry is very competitive and the Company competes against larger, well-capitalized national providers.

The Wireline segment faces competition from other local exchange carriers, wireless service providers, inter-exchange carriers, as well as cable, broadband,

and internet service providers. The Company has lost, and will likely continue to lose, access lines as a part of its customer base utilizes the services of

competitive wireline or wireless providers in lieu of the Company’s services. Wireless providers, particularly those that provide unlimited wireless service

plans with no additional fees for long distance, offer customers a substitution service for the Company’s local voice and long-distance services. The

Company believes this is the reason for the largest portion of the Company’s access line and long-distance line losses.

9