Cincinnati Bell 2014 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2014 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Form 10-K Part II

Cincinnati Bell Inc.

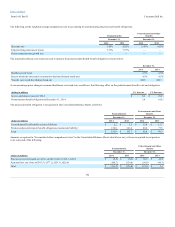

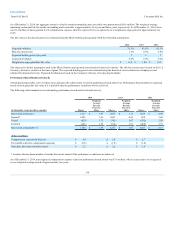

The Company sponsors several defined contribution plans covering substantially all employees. The Company's contributions to the plans are based on

matching a portion of the employee contributions. Both employer and employee contributions are invested in various investment funds at the direction of

the employee. Employer contributions to the defined contribution plans were $6.7 million, $6.6 million, and $6.9 million in 2014, 2013, and 2012,

respectively.

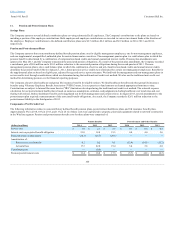

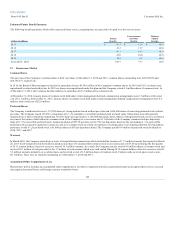

The Company sponsors three noncontributory defined benefit pension plans: one for eligible management employees, one for non-management employees,

and one supplemental, nonqualified, unfunded plan for certain former senior executives. The management pension plan is a cash balance plan in which the

pension benefit is determined by a combination of compensation-based credits and annual guaranteed interest credits. Pension plan amendments were

approved in May 2013, and the Company remeasured the associated pension obligations. As a result of the pension plan amendment, the Company recorded

a curtailment gain of $0.6 million and a $10.3 million reduction to the associated pension obligations during the second quarter of 2013. The non-

management pension plan is also a cash balance plan in which the combination of service and job-classification-based credits and annual interest credits

determine the pension benefit. Effective January 1, 2012, future pension service credits were eliminated for certain non-management employees. Benefits for

the supplemental plan are based on eligible pay, adjusted for age and service upon retirement. We fund both the management and non-management plans in

an irrevocable trust through contributions, which are determined using the traditional unit credit cost method. We also use the traditional unit credit cost

method for determining pension cost for financial reporting purposes.

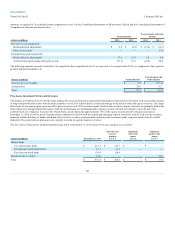

The Company also provides healthcare and group life insurance benefits for eligible retirees. We fund healthcare benefits and other group life insurance

benefits using Voluntary Employee Benefit Association ("VEBA") trusts. It is our practice to fund amounts as deemed appropriate from time to time.

Contributions are subject to Internal Revenue Service ("IRS") limitations developed using the traditional unit credit cost method. The actuarial expense

calculation for our postretirement health plan is based on numerous assumptions, estimates, and judgments including healthcare cost trend rates and cost

sharing with retirees. Retiree healthcare benefits are being phased out for both management and certain retirees. In August 2013, several amendments to the

postretirement plan required a remeasurement of the associated benefit obligations. As a result, the Company recorded a $26.1 million reduction to the

postretirement liability in the third quarter of 2013.

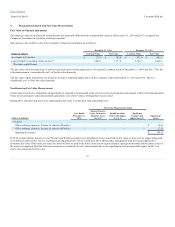

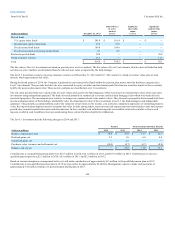

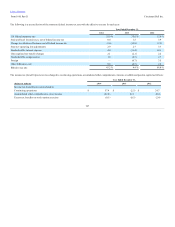

The following information relates to noncontributory defined benefit pension plans, postretirement healthcare plans, and life insurance benefit plans.

Approximately 8% in 2014, 10% in 2013, and 11% in 2012 of these costs were capitalized to property, plant and equipment related to network construction

in the Wireline segment. Pension and postretirement benefit costs for these plans were comprised of:

Service cost $ 1.0

$ 2.1

$ 2.6

$ 0.3

$ 0.4

$ 0.5

Interest cost on projected benefit obligation 21.0

18.8

21.3

4.0

4.0

5.6

Expected return on plan assets (28.1)

(25.7)

(26.1)

—

—

—

Amortization of:

Prior service cost (benefit) 0.2

0.2

0.1

(15.4)

(14.1)

(13.2)

Actuarial loss 17.3

22.0

19.4

5.4

5.6

6.8

Curtailment gain —

(0.6)

—

—

—

—

Pension/postretirement costs $ 11.4

$ 16.8

$ 17.3

$ (5.7)

$ (4.1)

$ (0.3)

100