Cincinnati Bell 2014 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2014 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Form 10-K Part II

Cincinnati Bell Inc.

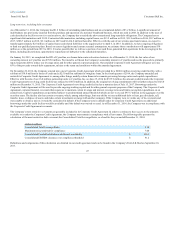

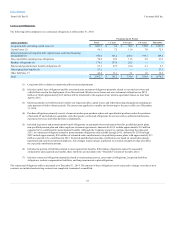

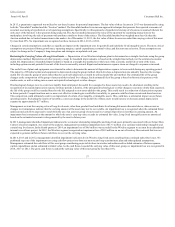

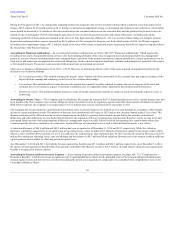

The following table summarizes our contractual obligations as of December 31, 2014:

Long-term debt, excluding capital leases (1)

$ 1,689.3

$ 6.0

$ 30.6

$ 310.8

$ 1,341.9

Capital leases (2)

98.1

7.2

11.0

7.0

72.9

Interest payments on long-term debt, capital leases, and other financing

arrangements (3)

750.0

121.2

240.5

199.1

189.2

Non-cancellable operating lease obligations

50.4

10.3

11.6

6.9

21.6

Purchase obligations (4)

178.1

157.9

20.2

—

—

Pension and postretirement benefits obligations (5)

63.3

27.5

22.4

4.1

9.3

Unrecognized tax benefits (6)

27.1

—

—

—

27.1

Other liabilities (7)

46.4

31.1

2.1

1.0

12.2

Total

$ 2,902.7

$ 361.2

$ 338.4

$ 528.9

$ 1,674.2

(1) Long-term debt excludes net unamortized discounts and premiums.

(2) Includes capital lease obligations and the associated asset retirement obligations primarily related to our wireless towers and

vehicle fleets used in the deployment of our fiber network. Wireless tower leases and asset retirement obligations are $83.2

million of which approximately $25 million will be transferred to the acquirer of our wireless spectrum licenses no later than

April 6, 2015.

(3) Interest payments on both fixed and variable rate long-term debt, capital leases, and other financing arrangements assuming no

early payment of debt in future periods. The interest rate applied on variable rate borrowings is the rate in effect as of December

31, 2014.

(4) Purchase obligations primarily consist of amounts under open purchase orders and open blanket purchase orders for purchases

of network, IT and telephony equipment, and other goods; contractual obligations for services such as software maintenance,

outsourced services; and other purchase commitments.

(5) Included in pension and postretirement benefit obligations are payments for postretirement benefits, qualified pension plans,

non-qualified pension plan and other employee retirement agreements. Amounts for 2015 include approximately $12 million

expected to be contributed for postretirement benefits. Although the Company expects to continue operating the plans past

2015, its contractual obligation related to postretirement obligations only extends through 2015. Amounts for 2015 through

2022 include approximately $30 million of estimated cash contributions to its qualified pension plans, with approximately $13

million expected to be contributed in 2015. Expected qualified pension plan contributions are based on current plan design,

legislation and current actuarial assumptions. Any changes in plan design, legislation or actuarial assumptions may also affect

the expected contribution amount.

(6) Includes the portion of liabilities related to unrecognized tax benefits. If the timing of payments cannot be reasonably

estimated for unrecognized tax benefits, these liabilities are included in the "Thereafter" column of the table above.

(7) Includes contractual obligations primarily related to restructuring reserves, asset removal obligations, long-term disability

obligations, workers compensation liabilities, and long-term incentive plan obligations.

The contractual obligations table is presented as of December 31, 2014. The amount of these obligations can be expected to change over time as new

contracts are initiated and existing contracts are completed, terminated, or modified.

52