Cincinnati Bell 2014 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2014 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Form 10-K Part II

Cincinnati Bell Inc.

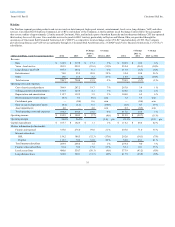

Depreciation and amortization was $231.0 million in 2014, an increase of $61.4 million compared to the prior year. The increase in depreciation expense is

primarily due to reducing the useful life of our long-lived wireless assets as a result of a continued decline in our subscriber base and the agreement to sell our

wireless spectrum licenses and certain other assets. Wireless depreciation and amortization expense totaled $103.4 million in 2014, up $62.2 million

compared to the prior year. Wireline depreciation and amortization increased by $3.5 million due to the expansion of our fiber-based network. IT Services

and Hardware was $1.2 million higher than the prior year as a result of new assets placed in service to support growth in managed and professional service

revenue. These increases were offset by a $5.2 million reduction due to the deconsolidation of CyrusOne.

Restructuring charges were $15.9 million in 2014 compared to $13.7 million in the prior year. In 2014, restructuring charges represented severance

associated with employee separations, consulting fees related to a workforce optimization initiative and lease abandonments. Charges incurred in 2014

include $4.2 million of severance cost for employee separations related to the wireless segment and outsourcing certain aspects of our IT department and

$13.1 million of contract termination fees related to winding down wireless operations. These charges were partially offset by a $1.4 million reduction to the

lease abandonment reserve related to certain leased space being reoccupied during the third quarter of 2014. Charges incurred during the comparative periods

of 2013 represented severance costs, expenses related to lease abandonments and fees associated with a workforce optimization initiative.

Transaction-related compensation was $42.6 million in 2013, of which $20.0 million was related to CyrusOne employees. In 2010, the Company's Board of

Directors approved a long-term incentive program for certain members of management under which payments were contingent upon the completion of a

qualifying transaction and attainment of an increase in the equity value of the data center business, as defined in the plan. The completion of the IPO during

2013 resulted in a qualifying transaction requiring payment of compensation to the employees covered under this plan. No such transaction-related

compensation has occurred in 2014.

During the three months ended June 30, 2013, the Company amended the management pension plan to eliminate all future pension service credits effective

July 1, 2013. As a result, the Company remeasured its projected benefit obligation for this plan, and the Wireline segment recognized a curtailment gain of

$0.6 million in the second quarter of 2013.

The gain on sale or disposal of assets totaled $0.3 million in 2014 compared to a loss on sale or disposal of assets of $2.4 million recorded in 2013. The

Wireline segment recorded gains on the sale of copper cabling that was no longer in use totaling $0.4 million and $1.1 million in 2014 and 2013,

respectively. The Corporate segment recorded a loss on sale or disposal of assets of $0.1 million in 2014 partially offsetting the gain. In 2013, Wireless

recorded a $3.5 million loss on disposal of assets for equipment that had no resale market or has either been disconnected from the wireless network,

abandoned or demolished.

Amortization of the deferred gain totaled $22.9 million in 2014 compared to $3.3 million in 2013. The change in the useful life of our long-lived wireless

assets, excluding the spectrum licenses, resulted in the acceleration of the amortization of the deferred gain in 2014. In December 2009, the Company sold

196 wireless towers for $99.9 million in cash proceeds and leased back a portion of the space on these towers for a term of 20 years, which resulted in a

deferred gain of $35.1 million.

Impairment charges totaling $12.1 million in 2014 included $7.5 million for certain construction-in-progress projects that will no longer be completed due to

the wind down of the wireless business and $4.6 million for the abandonment of an internal use software project that was written off in the Wireline segment.

No impairment charges were recorded in 2013.

Transaction costs of $4.4 million were incurred in 2014, up from $1.6 million incurred in 2013. In 2014, these costs primarily represent fees associated with

the sale of our wireless spectrum licenses. In 2013, these costs represented legal and consulting costs incurred to restructure our legal entities in preparation

for the proposed IPO of the common stock of CyrusOne and to prepare CyrusOne to be a real estate investment trust.

Interest expense was $148.7 million in 2014 compared to $182.0 million in 2013. The decrease was primarily due to the Company amending its Corporate

Credit Agreement to include a $540.0 million Tranche B Term Loan and using the proceeds to redeem all of the Company's $500.0 million 8 1/4% Senior

Notes on October 15, 2013. In addition, in the third quarter of 2014, the Company redeemed $325.0 million outstanding 8 ¾% Senior Subordinated Notes

due 2018 at a redemption price of 104.375%. The deconsolidation of CyrusOne in January 2013 also resulted in a $2.5 million decrease compared to the

prior year.

The Company recorded a loss on extinguishment of debt totaling $19.4 million in the third quarter of 2014 related to the redemption of $325.0 million 8 ¾%

Senior Subordinated Notes due 2018. In the fourth quarter of 2014, the Company redeemed $22.7 million of its outstanding 8 3/8% Senior Notes due 2020 at

par and recognized a loss on extinguishment of debt totaling $0.2 million.

31