Cincinnati Bell 2014 Annual Report Download - page 178

Download and view the complete annual report

Please find page 178 of the 2014 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193

|

|

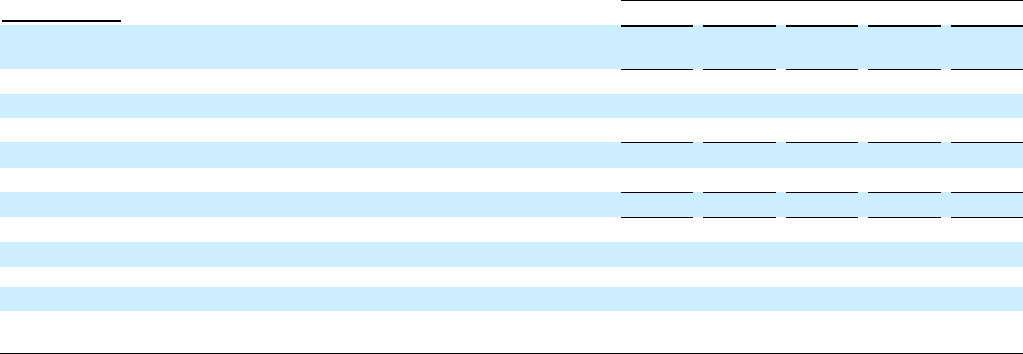

Exhibit 12.1

Calculation of Ratio of Earnings to Combined Fixed Charges and Preferred Dividends

Year ended December 31, 2014

(dollars in millions)

2014

2013

2012

2011

2010

Pre-tax income from continuing operations in consolidated subsidiaries plus fixed

charges*

$ 323.7

$ 163.2

$ 263.0

$ 267.0

$ 259.0

Fixed charges:

Interest expensed and capitalized

149.5

182.6

221.6

218.5

186.1

Appropriate portions of rentals

4.7

4.5

6.4

6.8

5.4

Total fixed charges

154.2

187.1

228.0

225.3

191.5

Pre-tax income required to pay preferred dividends

18.3

10.9

33.3

24.4

24.7

Total combined fixed charges and preferred dividends

$ 172.5

$ 198.0

$ 261.3

$ 249.7

$ 216.2

Ratio of earnings to fixed charges

2.1

—

1.2

1.2

1.4

Coverage deficiency**

n/a

23.9

n/a

n/a

n/a

Ratio of earnings to combined fixed charges and preferred dividends

1.9

—

1.0

1.1

1.2

Coverage deficiency**

n/a

34.8

n/a

n/a

n/a

* Earnings used in computing the ratio of earnings to combined fixed charges and preferred dividends consists of income from continuing

operations before income taxes, adjusted to exclude loss from equity method investees and fixed charges except for capitalized interest, and

adjusted to include dividends received from equity method investees.

** For the period in which a coverage deficiency is presented, earnings were inadequate to cover fixed charges or combined fixed charges and

preferred dividends by the amount of the deficiency.