Cincinnati Bell 2014 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2014 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Form 10-K Part II

Cincinnati Bell Inc.

Cash flows from investing activities

Cash flows provided by investing activities were $392.6 million in 2014, compared to cash used by investing activities of $185.4 million in 2013 and

$371.8 million in 2012. The increase in 2014 compared to the prior year is primarily due to the $355.9 million of proceeds received on the sale of CyrusOne

partnership units, in addition to cash proceeds totaling $194.4 million that were received on September 30, 2014 as a result of the completed wireless

spectrum sale. The deconsolidation of CyrusOne in 2013 increased cash used in investing activities by $19.5 million for the period January 1, 2013 through

January 23, 2013. Excluding CyrusOne, capital expenditures were down $6.9 million from the prior year largely due to a decreased investment in the wireless

network. Dividends received from CyrusOne were up $7.1 million compared to the prior year.

Capital expenditures were $196.9 million for 2013, which was $170.3 million lower than 2012 due primarily to the deconsolidation of CyrusOne, offset by

increased investment in our strategic fiber products. As a result of the CyrusOne IPO, we received dividends of $21.3 million from CyrusOne in 2013. In

2012, we deposited $11.1 million of cash into an escrow account and released $4.9 million from this account to fund construction of a data center.

Proceeds from the sale of assets, primarily copper cable, were $2.0 million in 2014 and 2013 compared to $1.6 million in 2012. Other cash from investing

activities in 2014 totaled $5.8 million as a result of two additional equity method investments.

Cash flows from financing activities

Cash flows used by financing activities were $514.5 million in 2014. Debt repayments totaling $376.5 million were primarily due to the redemption of

$325.0 million 8 3/4% Senior Subordinated Notes due 2018 at 104.375% and the $22.7 million repayment of 8 3/8% Senior Note due 2020 at par. In addition,

cash proceeds from the sale of wireless spectrum were used to repay $127.0 million on the Corporate Credit Agreement's revolving credit facility and

Receivables Facility.

Cash flows provided by financing activities were $87.6 million in 2013. The Company received $529.8 million in net proceeds from the Tranche B Term

Loan on September 10, 2013. In 2013, the Company also had net borrowings of $54.2 million under its Receivables Facility and $40.0 million on its

Corporate Credit Agreement's revolving credit facility. We also received cash proceeds of $7.1 million from the exercise of stock options and warrants.

Proceeds of the Tranche B Term Loan were used to redeem all of the Company's $500.0 million 8 1/4% Senior Notes on October 15, 2013 at a redemption

price of 104.125%.

Cash flows provided by financing activities were $109.0 million in 2012. During 2012, CyrusOne LP and CyrusOne Finance Corp. issued $525.0 million of 6

3/8% Senior Notes due 2022 and used $480.0 million of the $511.0 million net proceeds to repay intercompany payables. The Company repaid $442.4

million of debt during the year, largely with the net proceeds received from CyrusOne, including the redemption of the $247.5 million of 7% Senior Notes

due 2015, $91.1 million of 8 3/8% Senior Notes due 2020, purchased pursuant to a tender offer completed in the fourth quarter of 2012, and $73.0 million of

various series of CBT Notes due 2023. The Company also used the net proceeds received from CyrusOne to pay the redemption premiums, debt issuance and

other costs associated with this series of transactions and to repay the outstanding borrowings on our prior credit facility of $40.0 million. In 2012, the

Company also borrowed $52.0 million under its Receivables Facility and received cash proceeds of $12.1 million from the exercise of stock options and

warrants. In 2012, cash was used to fund $5.7 million of costs associated with the CyrusOne IPO.

Dividends paid on preferred stock totaled $10.4 million in 2014, 2013 and 2012.

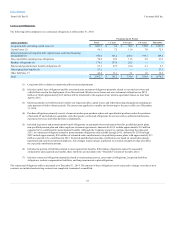

Wireline

For the first time since 2007, we generated year-over-year wireline revenue growth as demand for Fioptics and fiber-based products for business customers

more than offset revenue declines from our legacy products. During 2014, we invested $118.1 million in our strategic wireline products and revenue from

these products increased 23% totaling $310.5 million for the year.

49