Cincinnati Bell 2014 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2014 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Form 10-K Part II

Cincinnati Bell Inc.

The Company's ability to make restricted payments, which include share repurchases and common stock dividends, is limited to a total of $15 million

because its Consolidated Total Leverage Ratio, as defined in the Corporate Credit Agreement, exceeds 3.50 to 1.00 as of December 31, 2014. The Company

may make restricted payments of $45 million annually when the Consolidated Total Leverage Ratio is less than or equal to 3.50 to 1.00. There are no limits

on restricted payments when the Consolidated Total Leverage Ratio is less than or equal to 3.00 to 1.00. These restricted payment limitations do not impact

the Company's ability to make regularly scheduled dividend payments on its 6 3/4% Cumulative Convertible Preferred Stock. Furthermore, the Company may

make restricted payments in the form of share repurchases or dividends up to 15% of CyrusOne proceeds, subject to a $35 million annual cap with carryovers.

The Corporate Credit Agreement was also modified to provide that the Tranche B Term Loan participates in mandatory prepayments subject to the terms and

conditions (including with respect to payment priority) set forth in the restated Corporate Credit Agreement. In addition, the Corporate Credit Agreement

provides that 85% of proceeds from a CyrusOne monetization are applied to mandatory prepayments under the restated Corporate Credit Agreement, subject

to the terms and conditions set forth therein. Other revisions were also effected pursuant to the amended agreement, including with respect to financial

covenant compliance levels.

The Company’s public debt, which includes the 8 3/4% Senior Subordinated Notes due 2018 and the 8 3/8% Senior Notes due 2020, contains covenants that,

among other things, limit the Company’s ability to incur additional debt or liens, pay dividends or make other restricted payments, sell, transfer, lease, or

dispose of assets and make investments or merge with another company. The Company is in compliance with all of its public debt indentures as of

December 31, 2014.

One of the financial covenants permits the issuance of additional indebtedness up to a 4:00 to 1:00 Consolidated Adjusted Senior Debt to EBITDA Ratio (as

defined by the individual indentures). Once the Company exceeds this ratio, the Company is not in default under the terms of the indentures; however,

additional indebtedness may only be incurred in specified permitted baskets, including a basket which allows $900 million of total Corporate Credit

Agreement debt (Revolver and Term Loans). We also have baskets for capital lease incurrences, borrowings against the Receivables Facility, refinancings of

existing debt, and other debt incurrences. In addition, the Company's ability to make restricted payments, which include share repurchases, repayment of

subordinated notes and common stock dividends, would be limited to specific allowances. As of December 31, 2014, the Company was below the 4:00 to

1:00 Consolidated Adjusted Senior Debt to EBITDA ratio, and the Company has access to the restricted payments basket which exceeded $500 million as of

December 31, 2014.

Management believes that cash on hand, operating cash flows, its Corporate Credit Agreement and its Receivables Facility, and the expectation that the

Company will continue to have access to capital markets to refinance debt and other obligations as they mature and come due, should allow the Company to

meet its cash requirements for the foreseeable future.

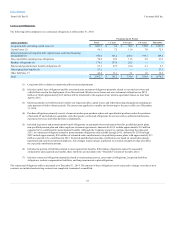

Cash flows from operating activities

Cash provided by operating activities during 2014 was $175.2 million, an increase of $96.4 million compared to 2013. This increase was largely driven by a

decrease in pension and postretirement payments of $30.8 million and a decrease in cash interest payments of $26.4 million compared to the prior year. In

addition, the increase is due to the payment of $42.6 million of transaction related compensation in 2013.

Cash provided by operating activities during 2013 was $78.8 million, a decrease of $133.9 million compared to 2012. This decrease was largely driven by

the deconsolidation of CyrusOne in January 2013, the $42.6 million payment of transaction related compensation, $16.0 million of higher pension and

postretirement payments and increased working capital usage.

48