Cincinnati Bell 2014 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2014 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Form 10-K Part II

Cincinnati Bell Inc.

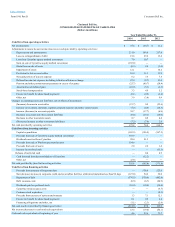

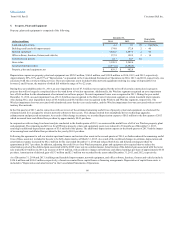

Net investment in real estate

$ 1,051.4

$ 883.8

Total assets

1,586.5

1,506.8

Total liabilities

869.5

729.2

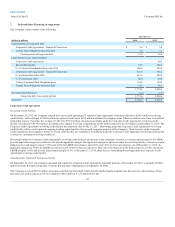

Revenues - The Company records service revenue from CyrusOne under contractual service arrangements which include, among others, providing services

such as fiber transport, network support, service calls, monitoring and management, storage and back-up, and IT systems support.

Operating Expenses - We lease data center and office space from CyrusOne at certain locations in our operating territory under operating leases and are also

billed for other services provided by CyrusOne under contractual service arrangements. In the normal course of business, the Company also provides certain

administrative services to CyrusOne which are billed based on agreed-upon rates. These expense recoveries from CyrusOne are credited to the expense

account in which they were initially recorded.

For the year ended December 31, 2013, we recognized transaction-related compensation of $20.0 million associated with payments made to CyrusOne

employees in April 2013. See Note 8 for further discussion of this compensation plan.

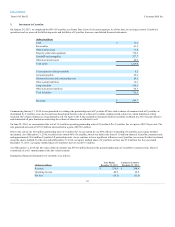

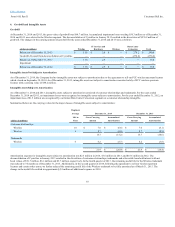

Revenues and operating costs and expenses from transactions with CyrusOne were as follows:

Services provided to CyrusOne

$ 1.7

$ 2.1

Transaction-related compensation to CyrusOne employees

$ —

$ 20.0

Charges for services provided by CyrusOne

9.1

8.8

Administrative services provided to CyrusOne

(0.5)

(0.6)

Total operating costs and expenses

$ 8.6

$ 28.2

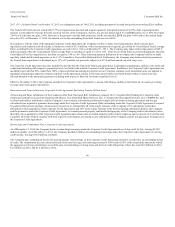

Dividends of $28.4 million and $21.3 million were received in 2014 and 2013, respectively. In addition, on November 4, 2014, CyrusOne declared dividends

of $0.21 per share payable on its common shares and CyrusOne LP partnership units. This dividend was paid on January 9, 2015 to holders of record as of

December 26, 2014.

In addition to the agreements noted above, the Company entered into a tax sharing agreement with CyrusOne. Under the terms of the agreement, CyrusOne

will reimburse the Company for the Texas Margin Tax liability that CyrusOne would have incurred if they filed a Texas Margin Tax return separate from the

consolidated filing. The agreement will remain in effect until terminated by the mutual written consent of the parties or when the Company is no longer

required to file the Texas Margin Tax return on a consolidated basis with CyrusOne. As of December 31, 2014 and 2013, the receivable for prior periods

covered by this agreement amounted to $1.7 million and $1.5 million, respectively. These balances are included in Receivable from CyrusOne.

84