Cincinnati Bell 2014 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2014 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Form 10-K Part II

Cincinnati Bell Inc.

Some of the leases were structured on a full-service gross basis in which the customer paid a fixed amount for both colocation rental and power. Other leases

provided that the customer would be billed for power based upon actual usage which was separately metered. In both cases, this revenue was presented on a

gross basis in the accompanying Consolidated Statements of Operations. Power was generally billed one month in arrears and an estimate of this revenue was

accrued in the month that the associated costs were incurred. We generally were not entitled to reimbursements for real estate taxes, insurance or other

operating expenses.

Revenue was recognized for services or products that were deemed separate units of accounting. When a customer made an advance payment which was not

deemed a separate unit of accounting, deferred revenue was recorded. This revenue was recognized ratably over the expected term of the customer

relationship, unless the pattern of service suggested otherwise.

Certain customer contracts required specified levels of service or performance. If we failed to meet these service levels, our customers may have been eligible

to receive credits on their contractual billings. These credits were recognized against revenue when an event occurred that gave rise to such credits.

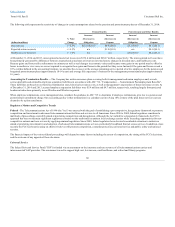

The allowance for uncollectible accounts is determined using historical percentages

of credit losses applied to outstanding aged receivables, as well as specific provisions for certain identifiable, potentially uncollectible balances.

Management believes its allowance for uncollectible accounts represents a reasonable estimate of future credit losses. However, if one or more of our larger

customers were to default on its accounts receivable obligations, or if general economic conditions in our operating area deteriorated, our future credit losses

could exceed the amount recognized in the allowance for uncollectible accounts receivable. Most of our outstanding accounts receivable balances are with

companies located within our geographic operating areas. As of December 31, 2014 and 2013, receivables with one large customer comprised 26% and 19%,

respectively, of the Company's total accounts receivable. Our Wireline, IT Services and Hardware, and Wireless segments comprise 88%, 8%, and 4% of the

allowance for uncollectible accounts receivable as of December 31, 2014, respectively.

The Company adheres to the amended guidance under ASC 350-20

in testing goodwill for impairment. Under this revised guidance, the Company has the option of performing a qualitative assessment for impairment prior to

performing the quantitative tests. A qualitative analysis was performed in 2014. In 2013, a quantitative analysis was performed. The Company performs

impairment testing of goodwill and indefinite-lived intangible assets on an annual basis or when events or changes in circumstances indicate that an asset

may be impaired. We perform our annual impairment tests in the fourth quarter when our five-year plan is updated.

Management estimates the fair value of each reporting unit using a combination of valuation methods, including both income-based and market-based

methods. The income-based approach utilizes a discounted cash flow model using projected cash flows derived from the five-year plan, adjusted to reflect

market participants' assumptions. Expected future cash flows are discounted at the weighted average cost of capital applying a market participant approach.

The market-based approach utilizes earnings multiples from comparable publicly-traded companies. No goodwill impairment losses were recognized in 2014,

2013 or 2012.

The Company adheres to the amended guidance under ASC 350-30 when testing indefinite-lived intangible assets, other than goodwill, for impairment,

allowing us to perform a qualitative assessment before performing quantitative tests. If the entity determines, on the basis of qualitative factors, that the fair

value of the indefinite-lived intangible asset is not more likely than not impaired, the entity would not need to perform the quantitative tests.

Prior to September 30, 2014 Wireless owned wireless spectrum licenses which were indefinite-lived intangible assets. Effective September 30, 2014 the

licenses were sold; therefore, no impairment test was performed in 2014. Simultaneous with the spectrum license sale, the company entered into agreements

to use certain spectrum licenses until we are able to shut-down our wireless operations. Therefore, the deferred gain totaling $112.6 million was recorded in

the Consolidated Balance Sheets as of December 31, 2014. The company plans to provide wireless service until no later than April 6, 2015.

56