Cincinnati Bell 2014 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2014 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Form 10-K Part II

Cincinnati Bell Inc.

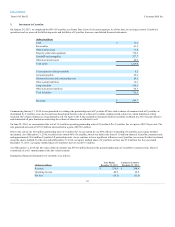

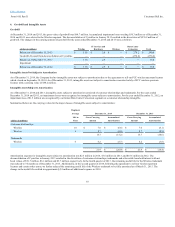

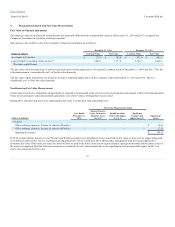

At December 31, 2014 and 2013, the gross value of goodwill was $64.7 million. Accumulated impairment losses totaling $50.3 million as of December 31,

2014 and 2013 were related to the Wireless segment. The deconsolidation of CyrusOne in January 2013 resulted in the divestiture of $276.2 million of

goodwill. The changes in the carrying amount of goodwill for the years ended December 31, 2014 and 2013 were as follows:

Balance as of December 31, 2012 $ 11.8

$ 2.6

$ —

$ 276.2

$ 290.6

Goodwill divested from deconsolidation of CyrusOne —

—

—

(276.2)

(276.2)

Balance as of December 31, 2013 11.8

2.6

—

—

14.4

Impairment —

—

—

—

—

Balance as of December 31, 2014 $ 11.8

$ 2.6

$ —

$ —

$ 14.4

As of December 31, 2014, the Company had no intangible assets not subject to amortization due to the agreement to sell our FCC wireless spectrum licenses

which closed on September 30, 2014. As of December 31, 2013, intangible assets not subject to amortization consisted solely of FCC wireless spectrum

licenses with a carrying value of $88.2 million.

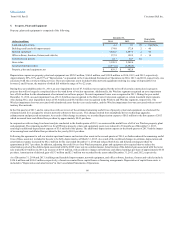

As of December 31, 2014 and 2013, intangible assets subject to amortization consisted of customer relationships and trademarks. For the years ended

December 31, 2014 and 2013, no impairment losses were recognized on intangible assets subject to amortization. For the year ended December 31, 2012, an

impairment loss of $1.5 million was recognized by our former Data Center Colocation segment on a customer relationship intangible.

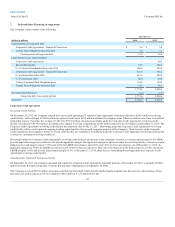

Summarized below are the carrying values for the major classes of intangible assets subject to amortization:

Customer relationships

Wireline 10

$ 7.0

$ (6.6)

$ 7.0

(6.1)

Wireless 9

8.7

(8.6)

8.7

(8.5)

15.7

(15.2)

15.7

(14.6)

Trademarks

Wireless 6

6.2

(5.7)

6.2

(3.8)

21.9

$ (20.9)

$ 21.9

$ (18.4)

Amortization expense for intangible assets subject to amortization was $2.5 million in 2014, $3.6 million in 2013, and $18.6 million in 2012. The

deconsolidation of CyrusOne in January 2013 resulted in the divestiture of customer relationships, trademarks and a favorable leasehold interest with net

book values of $91.7 million, $6.1 million and $3.7 million, respectively. In the fourth quarter of 2013, the remaining useful life for the Wireless trademark

was reduced to 30 months as of December 31, 2013. Additionally, in the second quarter of 2014, following the agreement to sell our wireless spectrum

licenses and certain other assets, we further reduced the remaining useful life of the Wireless trademark to be fully amortized as of March 31, 2015. The

change in the useful life resulted in approximately $1 million of additional expense in 2014.

87