Cincinnati Bell 2014 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2014 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Form 10-K Part II

Cincinnati Bell Inc.

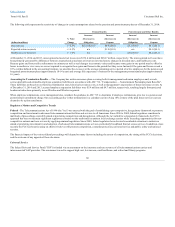

Interest Rate Risk

The Company has exposure to interest rate risk, primarily in the form of variable-rate borrowings from its Corporate Credit Agreement and Receivables

Facility and changes in current rates compared to that of its fixed rate debt. The Company's management periodically employs derivative financial

instruments to manage exposure to interest rate risk. At December 31, 2014 and 2013, the Company held no derivative financial instruments. As of

December 31, 2014 the Company had variable-rate borrowings of $533.2 million under the Tranche B Term Loan Facility, $19.2 million under the

Receivables Facility, and no borrowings under the Corporate Credit Agreement's revolving credit facility. The interest on these debt arrangements varies with

changes in the LIBOR rate. A hypothetical increase or decrease of one percentage point in the LIBOR rate would increase or decrease our annual interest

expense on these variable-rate borrowings by approximately $5.5 million, assuming no additional borrowings or repayments are made under these

agreements.

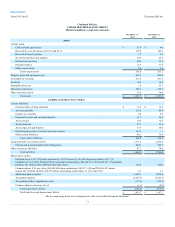

The following table sets forth the face amounts, maturity dates, and average interest rates at December 31, 2014 for our fixed and variable-rate debt,

excluding capital leases and other debt, and unamortized discounts:

Fixed-rate debt:

$ —

$ —

$ —

$ 300.0

$ —

$ 835.7

$ 1,135.7

$ 1,170.3

Weighted average interest rate on fixed-

rate debt

—

—

—

8.8%

—

8.0%

8.2%

—

Variable-rate debt:

$ 5.4

$ 24.6

$ 5.4

$ 5.4

$ 5.4

$ 506.2

$ 552.4

$ 545.8

Average interest rate on variable-rate debt

4.0%

1.4%

4.0%

4.0%

4.0%

4.0%

3.9%

—

At December 31, 2013, the carrying value and fair value of fixed-rate debt was $1,483.4 million and $1,562.5 million, respectively.

Foreign Currency Risk

Substantially all of our revenue and expenses are denominated in U.S. dollars. We do not currently employ forward contracts or other financial instruments to

mitigate foreign currency risk.

Commodity Price Risk

Certain of our operating costs are subject to price fluctuations caused by the volatility of the underlying commodity prices, gas utilized primarily by our field

operations group, and network and building materials, such as steel, fiber and copper, used in the construction of our networks.

66