Brother International 2013 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2013 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

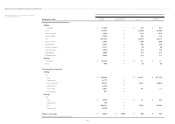

Notes to Consolidated Financial Statements

Brother Industries, Ltd. and Consolidated Subsidiaries

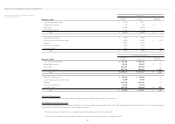

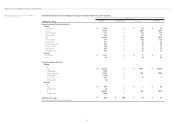

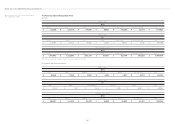

Year ended March 31, 2013 Millions of Yen

2012

Reportable segment

Printing &

Solutions

Personal

& Home

Machinery

& Solution

Network

& Contents Others Total

Reconciliations

Consolidated

Sales

Sales to external customers ¥ 337,226 ¥ 30,706 ¥ 70,423 ¥ 45,924 ¥ 13,111 ¥ 497,390 — ¥ 497,390

Intersegment sales or transfers — — — — 7,556 7,556 ¥ (7,556) —

Total ¥ 337,226 ¥ 30,706 ¥ 70,423 ¥ 45,924 ¥ 20,667 ¥ 504,946 ¥ (7,556) ¥ 497,390

Segment profit/(loss) ¥ 21,978 ¥ 2,604 ¥ 8,345 ¥ (19) ¥ 1,428 ¥ 34,336 ¥ (153) ¥ 34,183

Segment assets 218,486 21,489 55,274 31,869 58,199 385,317 (14,411) 370,906

Other:

Depreciation ¥ 15,425 ¥ 680 ¥ 1,332 ¥ 4,761 ¥ 871 ¥ 23,069 — ¥ 23,069

Amortization of goodwill 201 — 20 1,466 — 1,687 — 1,687

Investments in associated companies 425 46 9,772 1 1,416 11,660 — 11,660

Increase in property, plant and equipment and intangible assets

16,521 721 2,667 4,008 203 24,120 ¥ 3,746 27,866

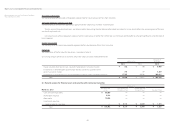

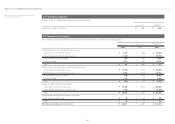

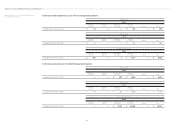

Thousands of U.S. Dollars

2013

Reportable segment

Printing &

Solutions

Personal

& Home

Machinery

& Solution

Network

& Contents Others Total

Reconciliations

Consolidated

Sales

Sales to external customers $ 3,732,298 $359,628 $653,362 $532,797 $ 211,989 $ 5,490,074 — $ 5,490,074

Intersegment sales or transfers — — — — 116,660 116,660 $

(116,660)

—

Total $ 3,732,298 $359,628 $653,362 $532,797 $ 328,649 $ 5,606,734 $

(116,660)

$ 5,490,074

Segment profit $ 200,277 $ 26,468 $ 42,617 $ 24,617 $ 23,957 $ 317,936 $ (1,170) $ 316,766

Segment assets 2,643,234 266,468 499,085 358,319 1,230,500 4,997,606

(513,617)

4,483,989

Other:

Depreciation $ 177,926 $ 10,447 $ 14,362 $ 43,681 $ 13,978 $ 260,394 — $ 260,394

Amortization of goodwill 894 — 213 13,989 — 15,096 — 15,096

Investments in associated companies 340 — 5,075 — 5,096 10,511 — 10,511

Increase in property, plant and equipment and intangible assets

160,979 11,766 30,021 61,383 11,894 276,043 $

45,638

321,681

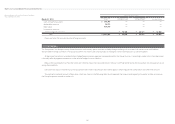

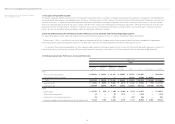

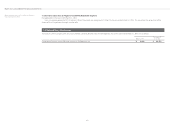

Notes:

(1) “Others” consists of real estate, leasing parts and other areas of business.

(2) Reconciliation amount is as follows:

1) Reconciliation amount of ¥10,966 million ($116,660 thousand) and ¥7,556 million for intersegment sales or transfers as of March 31, 2013 and 2012, respectively, is the elimination of intercompany transactions.

2) Reconciliation amount of ¥110 million ($1,170 thousand) and ¥153 million for segment profit/(loss) as of March 31, 2013 and 2012, respectively, is the elimination of intercompany transactions.

3) Reconciliation amount of ¥48,280 million ($513,617 thousand) and ¥14,411 million for segment assets as of March 31, 2013 and 2012, respectively, includes elimination of intercompany balances of ¥87,479 million

($930,628 thousand) and ¥67,409 million respectively, and corporate assets of ¥39,199 million ($417,011 thousand) and ¥52,998 million, respectively, which are not allocated to reportable segments.

4) Reconciliation amount of ¥4,290 million ($45,638 thousand) and ¥3,746 million for increase in property, plant and equipment and intangible assets for the years ended March 31, 2013 and 2012, respectively, are

corporate assets, which are not allocated to reportable segments.