Brother International 2013 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2013 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

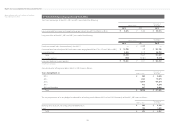

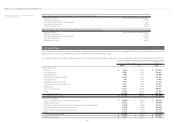

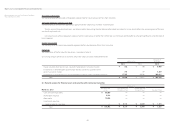

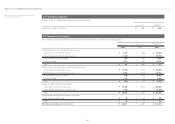

Millions of Yen

March 31, 2012

Carrying

Amount Fair Value

Unrealized

Gain/(Loss)

Cash and cash equivalents ¥ 58,732 ¥ 58,732 —

Marketable securities 475 476 ¥ 1

Receivables 64,186 64,186 —

Investment securities 11,541 11,542 1

Total ¥ 134,934 ¥ 134,936 ¥ 2

Short-term borrowings ¥ 4,467 ¥ 4,467 —

Current portion of long-term debt 16,363 16,435 ¥ (72)

Payables 49,394 49,394 —

Income taxes payable 2,592 2,592 —

Long-term debt 2,311 2,315 (4)

Total ¥ 75,127 ¥ 75,203 ¥ (76)

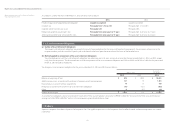

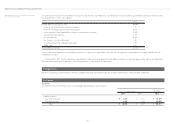

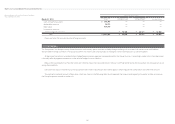

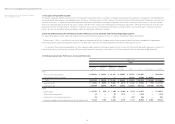

Thousands of U.S. Dollars

March 31, 2013

Carrying

Amount Fair Value

Unrealized

Gain/(Loss)

Cash and cash equivalents $ 585,745 $ 585,745 —

Marketable securities 56,574 56,585 $ 11

Receivables 838,979 838,979 —

Investment securities 239,319 240,648 1,329

Total $ 1,720,617 $ 1,721,957 $ 1,340

Short-term borrowings $ 69,415 $ 69,415 —

Current portion of long-term debt 9,670 9,670 —

Payables 479,138 479,138 —

Income taxes payable 31,894 31,894 —

Long-term debt 162,138 162,266 $ (128)

Total $ 752,255 $ 752,383 $ (128)

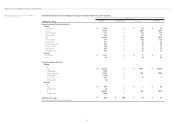

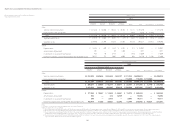

Cash and cash equivalents

The carrying values of cash and cash equivalents approximate fair value because of their short maturities.

Marketable and investment securities

The fair values of marketable and investment securities are measured at the quoted market price of the stock exchange for the equity instruments, and at the quoted price

obtained from the financial institution for certain debt instruments.

The carrying values of investment trusts approximate fair value because of their short maturities.

The fair value information for the marketable and investment securities by classification is included in Note 5.

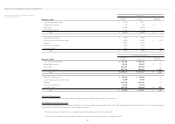

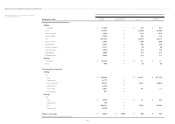

Notes to Consolidated Financial Statements

Brother Industries, Ltd. and Consolidated Subsidiaries

Year ended March 31, 2013