Brother International 2013 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2013 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30

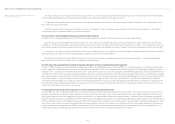

(5) Business Combinations

In October 2003, the Business Accounting Council issued a Statement of Opinion, “Accounting for Business Combinations,” and in December 2005, the ASBJ issued ASBJ

Statement No. 7, “Accounting Standard for Business Divestitures” and ASBJ Guidance No. 10, “Guidance for Accounting Standard for Business Combinations and Business

Divestitures.” The accounting standard for business combinations allowed companies to apply the pooling of interests method of accounting only when certain specific

criteria are met such that the business combination is essentially regarded as a uniting-of-interests. For business combinations that do not meet the uniting-of-interests

criteria, the business combination is considered to be an acquisition and the purchase method of accounting is required. This standard also prescribes the accounting for

combinations of entities under common control and for joint ventures.

In December 2008, the ASBJ issued a revised accounting standard for business combinations, ASBJ Statement No. 21, “Accounting Standard for Business Combinations.”

Major accounting changes under the revised accounting standard are as follows: (1) The revised standard requires accounting for business combinations only by the pur-

chase method. As a result, the pooling of interests method of accounting is no longer allowed. (2) The previous accounting standard required R&D costs to be charged to

income as incurred. Under the revised standard, in-process R&D costs (IPR&D) acquired in the business combination are capitalized as an intangible asset. (3) The previous

accounting standard provided for a bargain purchase gain (negative goodwill) to be systematically amortized over a period not exceeding 20 years. Under the revised

standard, the acquirer recognizes the bargain purchase gain in profit or loss immediately on the acquisition date after reassessing and confirming that all of the assets

acquired and all of the liabilities assumed have been identified after a review of the procedures used in the purchase price allocation. This revised standard was applicable

to business combinations undertaken on or after April 1, 2010.

The Company acquired the shares of Nissei Corporation through a tender offer on January 30, 2013, and accounted for it by the purchase method of accounting. The

related negative goodwill was immediately recognized in the consolidated statement of income as gain on negative goodwill (see Note 4).

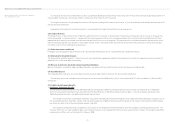

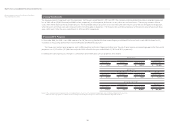

(6) Cash Equivalents

Cash equivalents are short-term investments that are readily convertible into cash and that are exposed to insignificant risk of changes in value.

Cash equivalents include time deposits and investment trust, all of which mature or become due within three months of the date of acquisition.

(7) Inventories

Inventories are stated at the lower of cost. The company and consolidated manufacturing subsidiaries determine cost by the average method. The consolidated sales

subsidiaries determine cost by using the average method or the first-in, first-out method.

(8) Marketable and Investment Securities

Marketable and investment securities are classified and accounted for, depending on management’s intent, as follows:

i) held-to-maturity debt securities, which management has the positive intent and ability to hold to maturity, are reported at amortized cost; and ii) available-for-sale

securities with market values, which are not classified as either of the aforementioned securities, are reported at fair value, with unrealized gains and losses, net of applicable

taxes, reported in a separate component of equity.

Nonmarketable available-for-sale securities are stated at cost determined by the moving-average method.

For other-than-temporary declines in fair value, marketable and investment securities are reduced to net realizable value by a charge to income.

(9) Property, Plant and Equipment

Property, plant and equipment are stated at cost. Depreciation is mainly computed by the declining-balance method.

Effective April 1, 2012, as a result of the revision of Japanese corporate tax law, the Company and its domestic consolidated subsidiaries changed their depreciation

method for property, plant and equipment acquired on or after April 1, 2012, to the method stipulated under the revised corporate tax law.

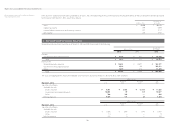

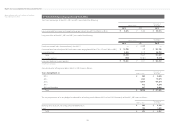

Notes to Consolidated Financial Statements

Brother Industries, Ltd. and Consolidated Subsidiaries

Year ended March 31, 2013