Brother International 2013 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2013 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

Notes to Consolidated Financial Statements

Brother Industries, Ltd. and Consolidated Subsidiaries

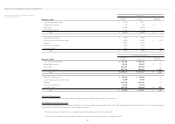

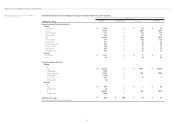

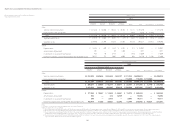

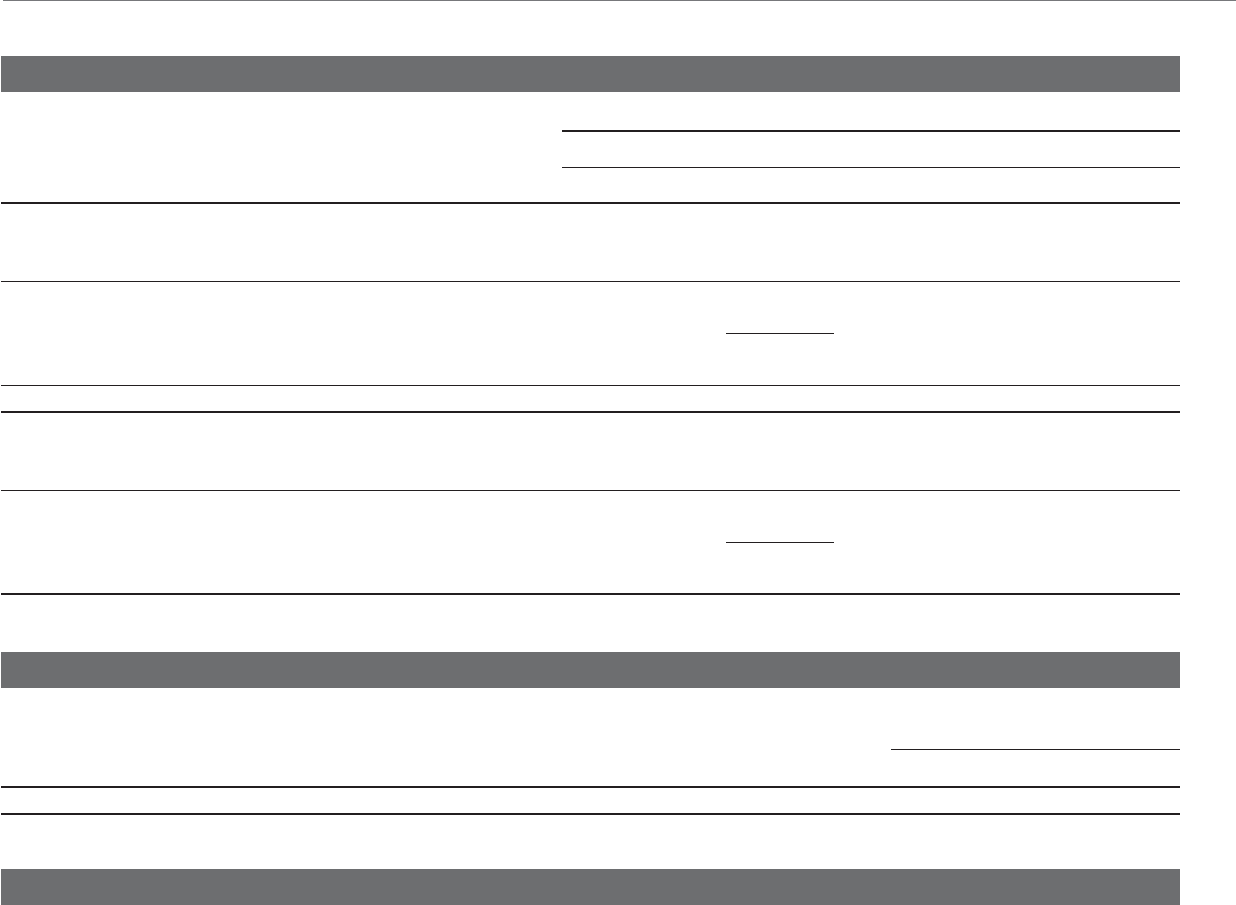

Year ended March 31, 2013 21. Net Income per Share

Reconciliation of the differences between basic and diluted net income per share (“EPS”) for the years ended March 31, 2013 and 2012, is as follows:

Millions of Yen

Thousands of

Shares Yen U.S. Dollars

Net Income

Weighted-Average

Shares EPS

For the year ended March 31, 2013:

Basic EPS

Net income available to common shareholders ¥ 17,826 267,473 ¥ 66.65 $ 0.71

Effect of dilutive securities

Stock acquisition rights 435

Diluted EPS

Net income for computation ¥ 17,826 267,908 ¥ 66.54 $ 0.71

For the year ended March 31, 2012:

Basic EPS

Net income available to common shareholders ¥ 19,525 267,659 ¥ 72.95

Effect of dilutive securities

Stock acquisition rights 364

Diluted EPS

Net income for computation ¥ 19,525 268,023 ¥ 72.85

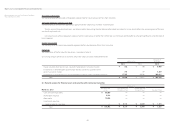

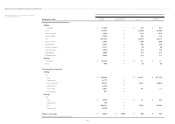

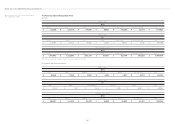

22. Subsequent Events

Appropriation of Retained Earnings

The following appropriation of retained earnings at March 31, 2013, was approved at the Company’s board of directors’ meeting held on May 14, 2013:

Millions of Yen

Thousands of

U.S. Dollars

Year-end cash dividends of ¥12 ($0.13) per share ¥ 3,226 $ 34,319

23. Segment Information

Under ASBJ Statement No. 17, “Accounting Standard for Segment Information Disclosures” and ASBJ Guidance No. 20, “Guidance on Accounting Standard for Segment

Information Disclosures,” an entity is required to report financial and descriptive information about its reportable segments. Reportable segments are operating segments

or aggregations of operating segments that meet specified criteria. Operating segments are components of an entity about which separate financial information is avail-

able and such information is evaluated regularly by the chief operating decision maker in deciding how to allocate resources and in assessing performance. Generally,

segment information is required to be reported on the same basis as is used internally for evaluating operating segment performance and deciding how to allocate

resources to operating segments.