Brother International 2013 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2013 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

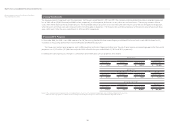

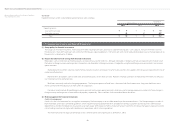

Market risk management (foreign exchange risk and interest rate risk)

Foreign currency trade receivables and payables are exposed to market risk resulting from fluctuations in foreign currency exchange rates. Such foreign exchange risk

of trade receivables is hedged principally by forward foreign currency contracts and currency option contracts. In addition, when foreign currency trade receivables

and payables are expected to arise from forecasted transactions, forward foreign currency contracts and currency option contracts may be used to hedge foreign

exchange risk resulting from forecasted transactions expected to occur within one year.

The executions and administration of derivatives have been approved by those who are granted authority based on the internal guidelines which prescribe the

authority and the limit for each transaction.

Liquidity risk management

Liquidity risk comprises the risk that the Group cannot meet its contractual obligations in full on their maturity dates. The Group manages its liquidity risk with ade-

quate financial planning by each company.

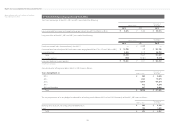

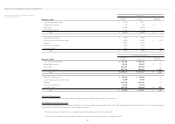

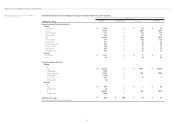

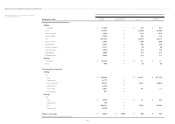

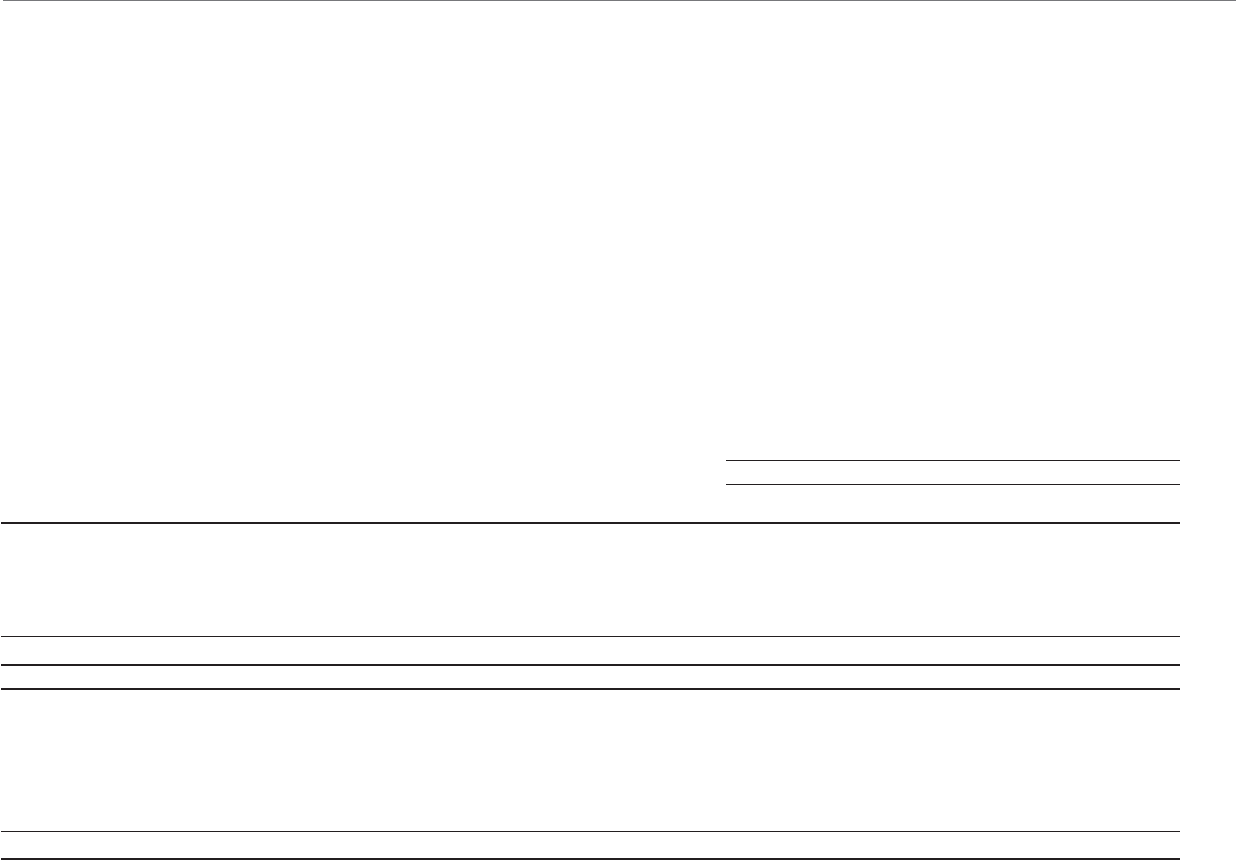

(4) Fair values of financial instruments

Fair values of financial instruments are based on quoted prices in active markets. If a quoted price is not available, other rational valuation techniques are used instead.

Also, please see Note 18 for the detail of fair value for derivatives.

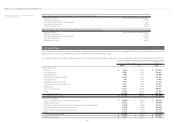

(a) Fair value of financial instruments

Millions of Yen

March 31, 2013

Carrying

Amount Fair Value

Unrealized

Gain/(Loss)

Cash and cash equivalents ¥ 55,060 ¥ 55,060 —

Marketable securities 5,318 5,319 ¥ 1

Receivables 78,864 78,864 —

Investment securities 22,496 22,621 125

Total ¥ 161,738 ¥ 161,864 ¥ 126

Short-term borrowings ¥ 6,525 ¥ 6,525 —

Current portion of long-term debt 909 909 —

Payables 45,039 45,039 —

Income taxes payable 2,998 2,998 —

Long-term debt 15,241 15,253 ¥ (12)

Total ¥ 70,712 ¥ 70,724 ¥ (12)

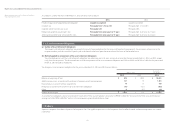

Notes to Consolidated Financial Statements

Brother Industries, Ltd. and Consolidated Subsidiaries

Year ended March 31, 2013