Brother International 2013 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2013 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

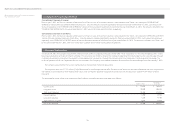

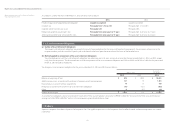

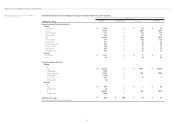

A reconciliation between the normal effective statutory tax rate and the actual effective tax rate reflected in the accompanying consolidated statement of income for the

year ended March 31, 2012, was as follows:

2012

Normal effective statutory tax rate 40.50%

Expenses not deductible for income tax purposes 2.56

Revenues not recognized for income tax purposes (0.45)

Lower income tax rates applicable to income in certain foreign countries (8.80)

Tax credit for R&D expenses (1.26)

Tax sparing credit (0.49)

Net change in valuation allowance 8.10

Undistributed earnings of foreign subsidiaries 2.30

Other – net 0.29

Actual e ective tax rate 42.75%

Since the difference between the normal effective statutory tax rate and the actual effective tax rate was not significant, a reconciliation was not presented for the year

ended March 31, 2013.

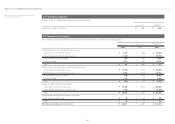

On December 2, 2011, new tax reform laws were enacted in Japan, which changed the normal effective statutory tax rate from approximately 40% to 38% effective for

the fiscal years beginning on or after April 1, 2012 through March 31, 2015, and to 35% afterwards.

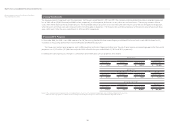

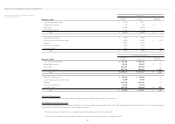

15. R&D Costs

R&D costs charged to income were ¥37,514 million ($399,085 thousand) and ¥39,232 million for the years ended March 31, 2013 and 2012, respectively.

16. Leases

(As lessee)

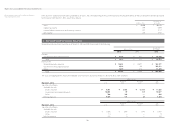

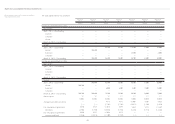

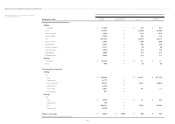

The minimum rental commitments under noncancellable operating leases were as follows:

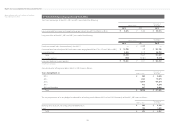

Millions of Yen

Thousands of

U.S. Dollars

2013 2012 2013

Operating leases:

Due within one year ¥ 1,597 ¥ 1,211 $ 16,989

Due after one year 8,453 2,510 89,926

Total ¥ 10,050 ¥ 3,721 $ 106,915

Notes to Consolidated Financial Statements

Brother Industries, Ltd. and Consolidated Subsidiaries

Year ended March 31, 2013