Brother International 2013 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2013 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

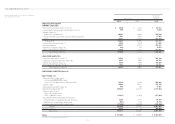

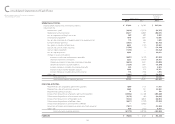

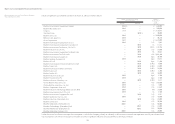

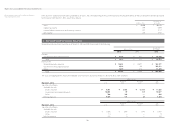

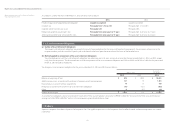

Notes to Consolidated Financial Statements

Brother Industries, Ltd. and Consolidated Subsidiaries

Year ended March 31, 2013 As a result, for the fiscal year ended March 31, 2013, consolidated depreciation decreased by ¥233 million ($2,479 thousand), and both of operating income and

income before income taxes and minority interests increased by ¥231 million ($2,457 thousand).

The range of useful lives was principally from three to 50 years for buildings and structures, from four to 12 years for machinery and vehicles and from two to 20

years for furniture and fixtures.

Depreciation of leased assets under finance leases is computed by the straight-line method over the lease period.

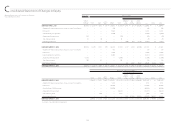

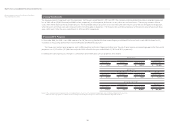

(10) Long-lived Assets

The Group reviews its long-lived assets for impairment whenever events or changes in circumstance indicate the carrying amount of an asset or asset group may

not be recoverable. An impairment loss is recognized if the carrying amount of an asset or asset group exceeds the sum of the undiscounted future cash flows

expected to result from the continued use and eventual disposition of the asset or asset group. The impairment loss would be measured as the amount by which

the carrying amount of the asset exceeds its recoverable amount, which is the higher of the discounted cash flows from the continued use and eventual disposi-

tion of the asset or the net selling price at disposition.

(11) Other Investments and Assets

Intangible assets and goodwill are carried at cost less accumulated amortization, which is calculated by the straight-line method.

(12) Allowance for Doubtful Accounts

The allowance for doubtful accounts is stated in amounts considered to be appropriate based on the companies’ past credit loss experience and an evaluation of

potential losses in the receivables outstanding.

(13) Bonuses to Directors and Audit & Supervisory Board Members

Bonuses to directors and Audit & Supervisory Board Members are accrued at the end of the year to which such bonuses are attributable.

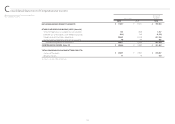

(14) Warranty Reserve

The Group provided a warranty reserve for repair service to cover all repair expenses based on the past warranty experience.

The warranty reserve was included in accrued expenses and amounted to ¥3,902 million ($41,511 thousand) and ¥4,277 million at March 31, 2013 and 2012,

respectively.

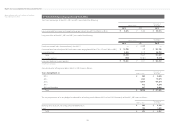

(15) Liability for Retirement Benefits

(i) Employees’ Retirement Benefits

The Company has a contributory funded defined benefit pension plan and a defined contribution pension plan covering substantially all of its employees.

Domestic consolidated subsidiaries have unfunded retirement benefit plans or defined contribution pension plans. Also, certain foreign subsidiaries have

defined benefit pension plans and defined contribution pension plans.

The Company and certain consolidated subsidiaries account for the liability for retirement benefits based on projected benefit obligations and plan assets at

the consolidated balance sheet date. Certain small subsidiaries apply the simplified method to state the liability at the amount which would be paid if employ-

ees retired, less plan assets at the consolidated balance sheet date.

The Company contributed certain available-for-sale securities to the employee retirement benefit trust for the Company’s contributory pension plans. The

securities held in this trust are qualified as plan assets. However, because it was expected that the fund status would remain in surplus, the Company cancelled a

certain portion of the asset and transferred it in February 2006.