Brother International 2013 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2013 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

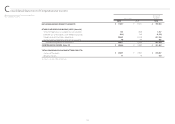

(ii) Retirement Benefits for Directors and Audit & Supervisory Board members

Certain domestic consolidated subsidiaries provide retirement allowances for directors and Audit & Supervisory Board members. Retirement allowances for directors

and Audit & Supervisory Board members are recorded to state the liability which would be paid at the amount if they retired at each consolidated balance sheet date.

The retirement benefits for directors and Audit & Supervisory Board members are paid upon the approval of the shareholders.

(16) Asset Retirement Obligations

In March 2008, the ASBJ published ASBJ Statement No. 18, “Accounting Standard for Asset Retirement Obligations” and ASBJ Guidance No. 21, “Guidance on Accounting

Standard for Asset Retirement Obligations.” Under this accounting standard, an asset retirement obligation is defined as a legal obligation imposed either by law or contract

that results from the acquisition, construction, development and the normal operation of a tangible fixed asset and is associated with the retirement of such tangible fixed

asset. The asset retirement obligation is recognized as the sum of the discounted cash flows required for the future asset retirement and is recorded in the period in which

the obligation is incurred if a reasonable estimate can be made. If a reasonable estimate of the asset retirement obligation cannot be made in the period the asset retire-

ment obligation is incurred, the liability should be recognized when a reasonable estimate of the asset retirement obligation can be made. Upon initial recognition of a

liability for an asset retirement obligation, an asset retirement cost is capitalized by increasing the carrying amount of the related fixed asset by the amount of the liability.

The asset retirement cost is subsequently allocated to expense through depreciation over the remaining useful life of the asset. Over time, the liability is accreted to its

present value each period. Any subsequent revisions to the timing or the amount of the original estimate of undiscounted cash flows are reflected as an adjustment to the

carrying amount of the liability and the capitalized amount of the related asset retirement cost.

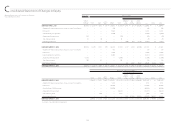

(17) Stock Options

The ASBJ Statement No. 8, “Accounting Standard for Stock Options” and related guidance are applicable to stock options granted on and after May 1, 2006. This standard

requires companies to measure the cost of employee stock options based on the fair value at the date of grant and recognize compensation expense over the vesting

period as consideration for receiving goods or services. The standard also requires companies to account for stock options granted to nonemployees based on the fair

value of either the stock option or the goods or services received. In the consolidated balance sheets, the stock options are presented as stock acquisition rights as a sepa-

rate component of equity until exercised. The standard covers equity-settled, share-based payment transactions, but does not cover cash-settled, share-based payment

transactions. In addition, the standard allows unlisted companies to measure options at their intrinsic value if they cannot reliably estimate fair value.

(18) R&D Costs

R&D costs are charged to income as incurred.

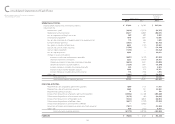

(19) Leases

In March 2007, the ASBJ issued ASBJ Statement No.13, “Accounting Standard for Lease Transactions,” which revised the previous accounting standard for lease transactions.

The revised accounting standard for lease transactions was effective for fiscal years beginning on or after April 1, 2008.

(Lessee)

Under the previous accounting standard, finance leases that were deemed to transfer ownership of the leased property to the lessee were capitalized. However, other

finance leases were permitted to be accounted for as operating lease transactions if certain “as if capitalized” information was disclosed in the note to the lessee’s financial

statements. The revised accounting standard requires that all finance lease transactions should be capitalized by recognizing lease assets and lease obligations in the

balance sheet. In addition, the accounting standard permits leases which existed at the transition date and do not transfer ownership of the leased property to the lessee

to be accounted for as operating lease transactions.

(Lessor)

Under the previous accounting standard, finance leases that were deemed to transfer ownership of the leased property to the lessee were treated as sales. However, other

finance leases were permitted to be accounted for as operating lease transactions if certain “as if sold” information is disclosed in the note to the lessor’s financial state-

ments. The revised accounting standard requires that all finance leases that are deemed to transfer ownership of the leased property to the lessee should be recognized as

lease receivables, and all finance leases that are not deemed not to transfer ownership of the leased property to the lessee should be recognized as investments in lease.

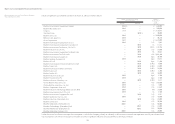

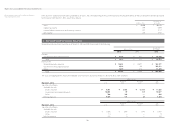

Notes to Consolidated Financial Statements

Brother Industries, Ltd. and Consolidated Subsidiaries

Year ended March 31, 2013