Brother International 2013 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2013 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

Notes to Consolidated Financial Statements

Brother Industries, Ltd. and Consolidated Subsidiaries

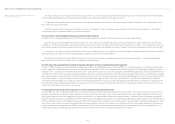

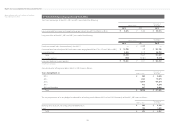

Year ended March 31, 2013 (25) Accounting Changes and Error Corrections

In December 2009, the ASBJ issued ASBJ Statement No. 24, “Accounting Standard for Accounting Changes and Error Corrections” and ASBJ Guidance No. 24, “Guidance on

Accounting Standard for Accounting Changes and Error Corrections.” Accounting treatments under this standard and guidance are as follows: (1) Changes in Accounting

Policies—When a new accounting policy is applied following revision of an accounting standard, the new policy is applied retrospectively unless the revised accounting

standard includes specific transitional provisions, in which case the entity shall comply with the specific transitional provisions. (2) Changes in Presentation—When the

presentation of financial statements is changed, prior-period financial statements are reclassified in accordance with the new presentation. (3) Changes in Accounting

Estimates—A change in an accounting estimate is accounted for in the period of the change if the change affects that period only, and is accounted for prospectively if the

change affects both the period of the change and future periods. (4) Corrections of Prior-Period Errors—When an error in prior-period financial statements is discovered,

those statements are restated.

(26) Consolidated corporate tax system

The Company applied a consolidated corporate tax system from the year ended March 31, 2013.

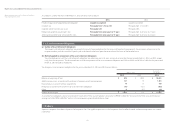

(27) New Accounting Pronouncements

Accounting Standard for Retirement Benefits—On May 17, 2012, the ASBJ issued ASBJ Statement No. 26, “Accounting Standard for Retirement Benefits” and ASBJ

Guidance No. 25, “Guidance on Accounting Standard for Retirement Benefits,” which replaced the Accounting Standard for Retirement Benefits that had been

issued by the Business Accounting Council in 1998 with an effective date of April 1, 2000, and the other related practical guidance, and followed by partial

amendments from time to time through 2009.

Major changes are as follows:

(a) Treatment in the balance sheet

Under the current requirements, actuarial gains and losses and past service costs that are yet to be recognized in profit or loss are not recognized in the balance

sheet, and the difference between retirement benefit obligations and plan assets (hereinafter, “deficit or surplus”), adjusted by such unrecognized amounts, is recog-

nized as a liability or asset.

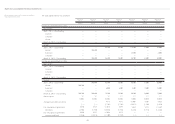

Under the revised accounting standard, actuarial gains and losses and past service costs that are yet to be recognized in profit or loss shall be recognized within

equity (accumulated other comprehensive income), after adjusting for tax effects, and any resulting deficit or surplus shall be recognized as a liability (liability for

retirement benefits) or asset (asset for retirement benefits).

(b) Amendments relating to the method of attributing expected benefit to periods and relating to the discount rate and expected future salary increases

The revised accounting standard also made certain amendments relating to the method of attributing expected benefit to periods and relating to the discount rate

and expected future salary increases.

This accounting standard and the guidance for (a) above are effective for the end of annual periods beginning on or after April 1, 2013, and for (b) above are effective for

the beginning of annual periods beginning on or after April 1, 2014, or for the beginning of annual periods beginning on or after April 1, 2015, subject to certain disclosure

in March 2015, both with earlier application being permitted from the beginning of annual periods beginning on or after April 1, 2013. However, no retrospective applica-

tion of this accounting standard to consolidated financial statements in prior periods is required.

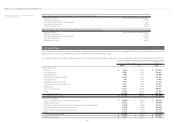

The Company and domestic subsidiaries expect to apply the revised accounting standard for (a) above from the end of the annual period beginning on April 1, 2013,

and for (b) above from the beginning of the annual period beginning on April 1, 2014, and is in the process of measuring the effects of applying the revised accounting

standard in future applicable periods.