Brother International 2013 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2013 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

17

Business Overview

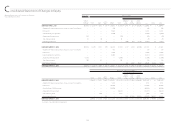

In fiscal 2012, despite a decrease in Machinery & Solution business due to a weak market, demand for communications and printing equipment, home sewing machines and

online karaoke machines remained solid. We also experienced an increase due to exchange primarily against the US dollar. As a result, net sales at Brother Group rose by

3.8% year-on-year to ¥516,067 million. However, despite significant improvements made in the online karaoke business in Network & Contents business due to a decrease in

Machinery & Solution business as a well as a decrease caused by exchange primarily against the euro, operating income fell year-on-year by 12.9% to ¥29,776 million.

Despite calculation of gain on negative goodwill related to acquisition of shares in Nissei Corporation, due to an increase in losses on valuation of derivatives accompanying

sudden fluctuations in foreign exchange, net income fell by 8.7% year-on-year to ¥17,826.

Performance by Business Segment

For details about performance by business segment, please see “Review of Operations,” Pages 10-11.

Fund Procurement, Liquidity and Cash Flows

The Brother Group’s financial policies ensure flexible and efficient funding and maintain an appropriate level of liquidity for current and future operating activities. In accor-

dance with these policies, we have created and operated a cash management system to optimize the group-wide use of cash held by individual companies. We also

maintain open commitment lines of credit with several banking institutions to complement existing liquidity on hand. Through these measures, we have established a

system to correct the uneven distribution of funds and minimize the overall borrowing needs of the Group.

Liquidity Management

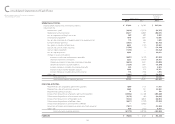

The Group’s liquidity on hand consists of cash and cash equivalents and the unused portion of open commitment lines of credit. As of March 31, 2013, cash and cash

equivalents totaled ¥55,060 million.

We maintain open commitment lines of credit with several financial institutions for a combined amount of ¥20,000 million. The amount in open commitment lines of

credit that was unused as of March 31, 2013 was ¥18,600 million. This total plus cash and cash equivalents was ¥73,659 million at fiscal year-end. Taking into consider-

ation seasonal funding requirements, debt payable within one year and business environment risks, we believe that we have sufficient liquidity on hand to support our

operations through a whole year.

Fund Procurement

As a basic rule, we procure working capital and other short-term funding in short-term borrowings within one year that is funded with local currency. The basic policy on

long-term funding for manufacturing facilities is that funds should come from internal reserves, fixed-rate long-term debt and corporate bonds. As of March 31, 2013, short-

term borrowings stood at ¥6,525 million, primarily denominated in yen. The balance of unsecured loans from a bank was ¥12,700 million, all procured in fixed-rate debt

procured in yen.

We have obtained credit ratings from Rating and Investment Information, Inc. (R&I). As of March 31, 2013, R&I assigned the Group’s long-term bonds and issuer credit

“A” ratings and its commercial paper an “a-1” rating. We consider consistent ratings important in maintaining our access to credit and capital markets.

The Brother Group believes that its liquidity on hand, including open commitment lines of credit, and sound corporate finance structure, on top of its ability to generate

cash flows from operating activities, make it possible to secure working capital as well as funds for capital investment and R&D investment to maintain the Group’s growth.

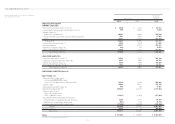

Cash Flows

Cash flows from operating activities

Net cash provided by operating activities amounted to ¥32,734 million, ¥6,593 million less than ¥39,327 million in the previous year. This was primarily because of a

decrease in income before income taxes and minority interests from the previous year.

Cash flows from investing activities

Net cash used in investing activities amounted to ¥41,772 million, ¥11,014 million more than ¥30,758 million used in the previous year, reflecting increases in disburse-

ment for purchases of property, plant and equipment and acquisition of a newly consolidated subsidiary, net of cash acquired.

Cash flows from financing activities

Net cash used in financing activities totaled ¥6,413 million, ¥7,705 million less than ¥14,118 million used in the previous year. Interest-bearing debt totaled an expenditure of

¥7,666 million in the previous year, but an income of ¥31 million in the current year. Cash dividends paid was ¥6,451 million, at the same level as the previous year.

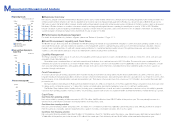

Net sales (left)

Operating income (right)

Net income (right)

Operating Results

(¥ billion) (¥ billion)

502.8497.4516.1

0

100

200

300

400

500

600

201320122011 0

10

20

30

40

50

60

34.2

26.2

36.1

19.5

Fiscal years ended March 31

29.8

17.8

Cash and Cash Equivalents,

End of Year

(¥ billion)

65.1 58.7 55.1

As of March 31

0

20

40

60

80

100

201320122011

Interest-bearing Debt

(¥ billion)

30.4

23.1 22.7

As of March 31

0

10

20

30

40

201320122011

anagement’s Discussion and Analysis

M