Brother International 2013 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2013 Brother International annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

Notes to Consolidated Financial Statements

Brother Industries, Ltd. and Consolidated Subsidiaries

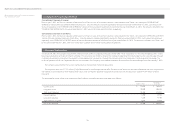

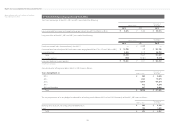

Year ended March 31, 2013 Assumptions used for the years ended March 31, 2013 and 2012, were as follows:

2013 2012

Periodic recognition of projected benefit obligation Straight-line method Straight-line method

Discount rate Principally from 1.5% to 2.0% Principally from 1.5% to 2.0%

Expected rate of return on plan assets Principally 3.0% Principally 3.0%

Recognition period of actuarial gain / loss Principally from seven years to 17 years Principally from seven years to 17 years

Amortization period of prior service benefit / cost Principally from seven years to 16 years Principally from seven years to 16 years

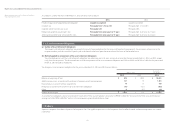

11. Asset Retirement Obligations

(a) Outline of Asset Retirement Obligations

The Group’s asset retirement obligations are primarily the result of legal obligations for the removal of leasehold improvements, the restoration of premises to the

original condition, and the removal of liquid crystal in the karaoke machines upon the termination of the lease of the karaoke house.

(b) Method applied to computation of the asset retirement obligations

The estimated periods until the asset retirement obligations are settled are one to 33 years and one to 34 years for the years ended March 31, 2013 and 2012, respec-

tively, from the acquisition. The discounted rates used for computation of the asset retirement obligations are 0.10% to 3.48% and 0.13% to 3.48% for the years ended

March 31, 2013 and 2012, respectively.

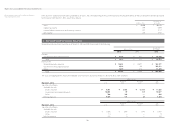

The changes in asset retirement obligations for the years ended March 31, 2013 and 2012, were as follows:

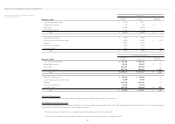

Millions of Yen

Thousands of

U.S. Dollars

2013 2012 2013

Balance at beginning of year ¥ 973 ¥ 1,022 $ 10,351

Additional provisions associated with purchases of property, plant and equipment 127 78 1,351

Reconciliation associated with passage of time 14 15 149

Reduction associated with settlement of asset retirement obligations (81) (121) (862)

Other 6(21) 64

Balance at end of year ¥ 1,039 ¥ 973 $ 11,053

Asset retirement obligations above were included in both of the “Other current liabilities” among the “CURRENT LIABILITIES” section and the “Other long-term liabilities”

among the “LONG-TERM LIABILITIES” section in the accompanying consolidated balance sheet.

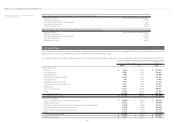

12. Equity

Japanese companies have been subject to the Companies Act. The significant provisions in the Companies Act that affect financial and accounting matters are summa-

rized below: